Latest Bicycle Sales Data from Key Cycling Nations Shows Further e-Bike Growth

Germany and The Netherlands

Two detailed reports from Germany and The Netherlands show that the bicycle market is solid there, and far larger on a per-capita basis than Australia’s.

E-Bikes Now Outsell Analogue Bikes in Germany

Germany has long been the largest national cycling market in Europe and due to the very high average unit value of bicycles, on of the top markets in the world.

On 13th March 2024, bicycle sales data for calendar year 2023 was released by the German Bicycle Industry Association (ZIV).

Although it would surely be extremely difficult to measure, the ZIV says the total fleet of active bicycles in Germany is 84 million units, of which 11 million are e-bikes.

In 2023, more e-bikes were sold in Germany than bicycles for the first time: e-bikes held a 53% share of the market with 2.1 million units sold (2022: 48%) and analogue bicycles a 47% share with 1.9 million units sold (2022: 52%).

The market share of bicycles sold via specialist retailers increased by 1% to 77%.

Of the 4 million total bicycles sold, 2.3 million were made (or at least assembled) in Germany and a further 710,000 were made offshore by contract manufacturers for German brands.

The total bicycle market retail value (for complete e-bikes and analogue bikes only) was €7.06 billion (A$11.65 billion) in 2023. This was slightly down on the €7.36 billion (A$12.14 billion) in 2022 but up on the €6.56 billion (A$10.8) in 2021 and well up on the pre-covid €4 billion (A$6.6 billion) in 2019.

Most of this big market value growth has been driven by the higher unit value of e-bikes.

The average retail value of analogue bikes sold in 2023 was €470 (A$775) which is far higher than the average retail value of bikes sold in Australia. But the average retail value of e-bikes sold in Germany is through the roof at €2,950 (A$4,867), which is over four times higher than Australia.

The ZIV points out that one reason for this high value, which has been increasing over recent years, is the growing proportion of cargo bikes sold in Germany, which are typically more expensive.

“Overall, the market data shows very clearly that people in Germany greatly value cycling in everyday life and recreation, along with the associated high-quality products,” said ZIV CEO Burkhard Stork. “The bicycle market thus remained at a consistently high level, defying the generally negative consumer climate in 2023. Consumers value bicycles – and especially e-bikes – offering high quality and innovative technology as well as the advice and services provided by qualified specialist retailers and their workshops.”

Leasing options through employers have also become an important market driver in Germany. Experts estimate that around one in four bikes is provided via a leasing agreement.

A Vastly Different Market Mix to Australia’s

The German bicycle market is dramatically different from Australia’s sport and leisure orientated product mix. In Germany in 2023 86.5% of bicycles sold were for non-sporting purposes and only 13.5% for sporting road race, gravel and MTB bikes combined.

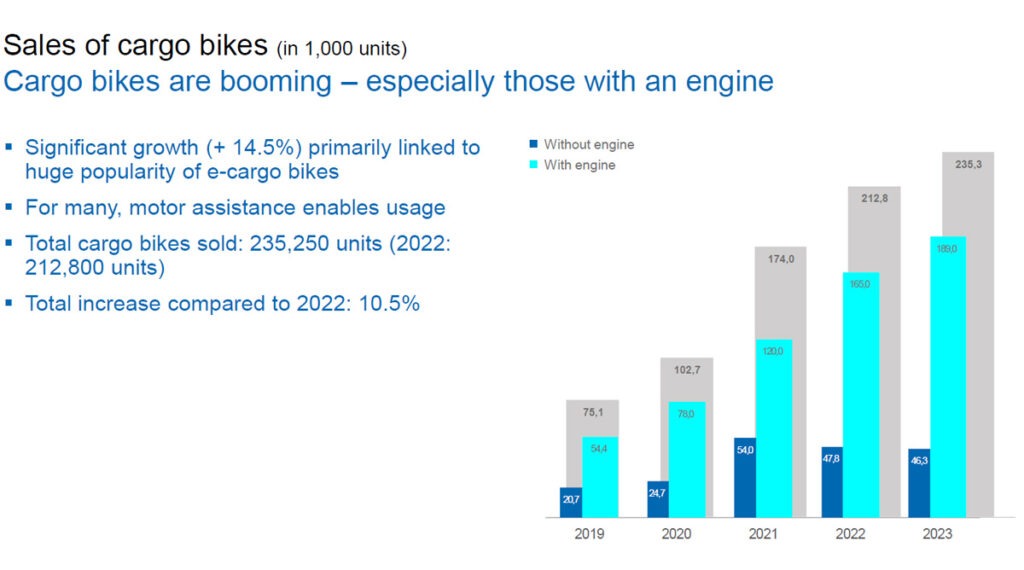

The Germany cargo bikes market has grown from 75,100 units in 2019 to 235,300 units in 2023 with 79% of these being e-cargo bikes.

The chart below illustrates this rate of growth. “Engine” is the German English translation for “electric motor”. You can see that analogue cargo bikes sales have been declining for the past three years while the market share of e-cargo bikes has steadily grown.

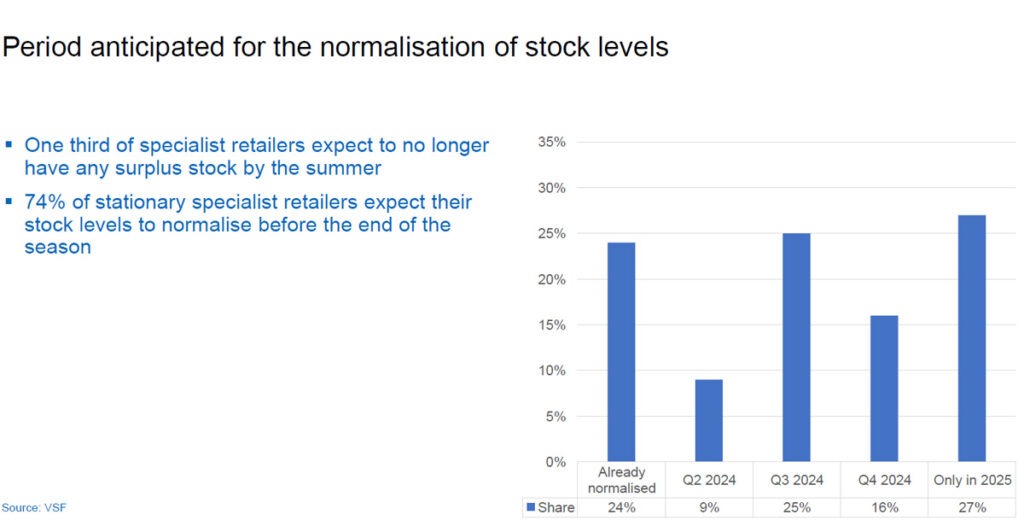

As the chart below shows, there were a wide range of responses from German specialist retailers as to when they anticipate clearing all of their surplus stock.

Netherlands Update – E-Bikes Now Account for 80% of Total Bicycle Sales Value

The Netherlands only has 17.7 million residents, significantly fewer than Australia’s 26 million and Germany’s 84 million.

It’s also 185 times smaller than Australia in land mass, in fact, it covers only 60% of the area of our smallest state, Tasmania, so the population density if far higher in the Netherlands.

A total of 804,000 new bicycles were sold in the Netherlands in 2023, down from 855,000 in 2022. The total bicycle sales value was €1.46 billion (A$2.4 billion), down slightly on 2022 but up 16.5% on the pre-covid 2019 figure.

Within total bicycle sales, e-bikes accounted for 56% by volume and a staggering 80% by value at €1.17 billion (A$1.93 billion) worth of e-bikes sold in 2023. The average e-bike sold in 2023 was valued at €2,574 (A$4,247).