What Do Tesla’s Battery Day Announcements Mean for Ebikes?

After months of largely Coronavirus induced logistical delays, on Tuesday 21st September, Tesla finally presented their much hyped and anticipated ‘Battery Day’ as part of their annual shareholder meeting.

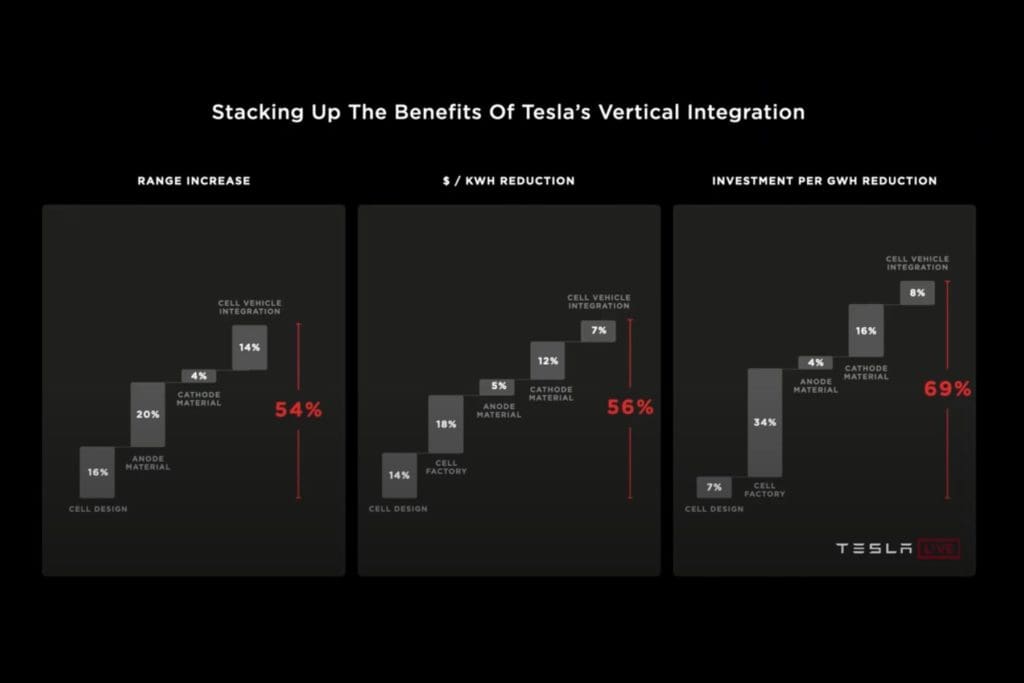

You can watch the event here. But to summarise the long and detailed technical presentation into a single graphic, please refer to the summary slide from the presentation that we’ve included in this article.

Tesla founder Elon Musk was deliberately vague about how long it would take for these three sets of changes and improvements to be implemented. At different times within his presentation, in relation to various specific elements, he suggested time frames from one to three years.

To explain the three charts from left to right within the as yet imprecise timeframe mentioned above Tesla is claiming that they will:

- Increase battery energy density so that the range of electric vehicles can increase by 54%.

- Decrease the cost per kilowatt-hour of batteries by 56%.

- Decrease the capital investment required to make each new gigawatt-hour of battery manufacturing capacity by 69%

It’s beyond the scope of this article to discuss the details of how Tesla plans to achieve these massive advances in such a short space of time. But if you watch the detailed presentation we’ve linked to above, you will learn that most of the key elements are already well underway.

Tesla does not make ebikes but it’s almost certain that via competitive pressures, technology licencing and other means, these new technologies will soon trickle down into ebikes and e-scooters of all model types.

What will this mean? Taking the projected improvements at face value, an ebike with a battery currently costing A$1,000 and giving a range of 50 kilometers would now cost $440 and give a range of 77 kilometres.

Or if you were happy with the same 50 kilometre range and opted for a smaller battery it would cost just $285 (dividing $440 by 1.54 and assuming price dropped pro rata per unit of capacity). The smaller battery would also be significantly lighter.

Clearly these are ‘game changing’ improvements in price and range.

Of course, Mr Musk and his team can say whatever they like. What matters is if they can deliver.

Tesla have a far from perfect track record in delivering promised products within their self-imposed timelines and Elon Musk is certainly not everyone’s favourite entrepreneur. But given his track record of technological breakthroughs both in cars via Tesla and rockets via SpaceX, the financial markets are certainly speculating heavily upon further advances.

As of 1st September 2020 Tesla was not only the most valuable car manufacturer in the world with a market capitalisation of US$442.7 billion (A$606 billion), but more than double the value of its nearest rival, the vastly larger Toyota, and more than 10 times the value of the once all powerful global leader, General Motors.