Velosure – Boosted Coverage for eBikes

– Sponsored Content –

It may come as a surprise to some, but many home and contents insurance policies won’t cover the theft of an ebike as they would a regular bicycle. Likewise, many cycling-specific policies won’t cover ebikes either.

With their surging popularity, ebikes sales are outstripping regular bikes for many retailers, so there’s a rapidly growing user group who can’t get coverage for their property. What’s more, ebikes are more likely to be put to task in utilitarian applications where they’ll be left locked up but unattended; doing the groceries, commuting to work, dropping in to the post office and many other day-to-day tasks. It’s an unfair situation for ebike owners, especially when assisted bikes cost substantially more than their non-assisted equivalents.

Recognising this inequity, Velosure (part of the global Two Three Bird insurance company) quickly adapted to the trend to ensure that ebikes were covered as part of their insurance offerings. This applies to electric pedal assist bicycles not exceeding 250 watts that have a maximum assisted speed of 25kph. To be covered, the bike needs to be purchased as a factory supplied electric bicycle as opposed to a retrofitted kit.

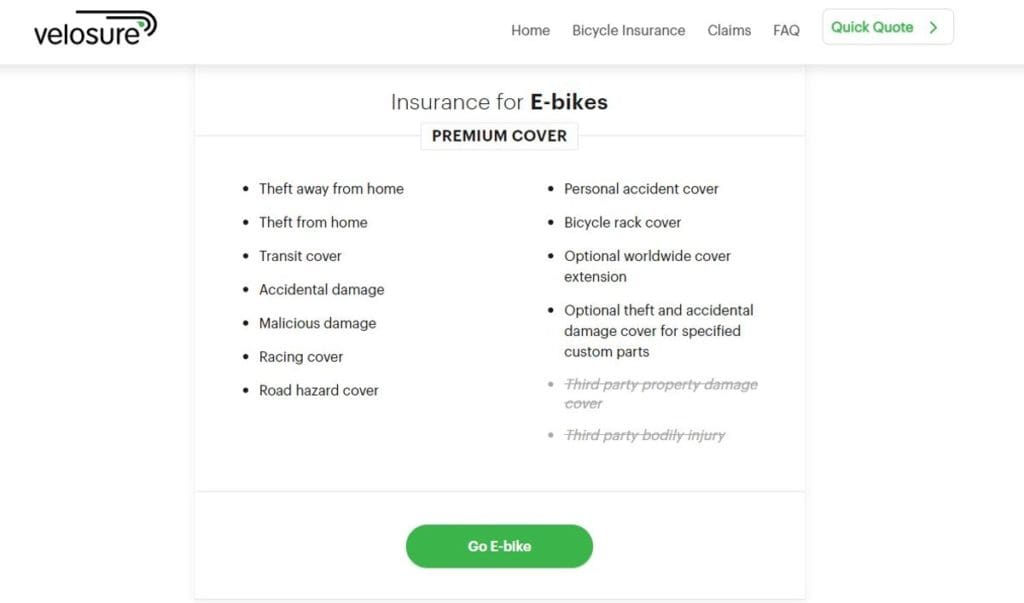

Their coverage includes theft both from home and away from home (as long as the ebike is secured by an approved lock), along with cover for accidental damage. They also cover ebikes against damage whilst being transported on a bike rack and offer an optional extension for overseas travel and custom bike parts. There’s even an element of personal injury cover and coverage at competitive events (as with any insurance the PDS should be read for the terms and conditions).

While it’s not the retailers’ role to sell insurance, knowing that legitimate ebike insurance exists can assist with consumer inquiries when making a sale. The average value of the ebikes protected by Velosure is around $6,000 and, in many cases, they serve as a substitute for a car or motorbike, so it makes sense for customers to seek out coverage. Knowing that such protection exists can reassure your customer that their investment will be protected if the worst happens—this can be a crucial step in facilitating a sale.

For easy and instantaneous insurance, the buyer can sign up for 30 days of complimentary insurance under Velosure’s ‘New Bike Day Program’.

This provides the majority of the benefits of their premium ebike coverage with protection against theft, damage, transit cover and even coverage while racing. The only thing it lacks is the optional worldwide cover extension.

Participating stores can assist the new bike owner by directing the customer to the free coverage before their ebike leaves the store. It’s a great way to provide peace of mind, furthering your relationship with the customer, and empowering your store to deliver a more holistic package.

To find out more about New Bike Day insurance and their other packages, check out www.velosure.com.au or contact Velosure directly on 1300 110 048.