How’s Business – June 2020: Special Expanded Edition!

It was already obvious from last month’s How’s Business responses that the Covid-19 virus has caused an unprecedented boom in demand for workshop services and certain categories of bicycles and P&A.

This month I wanted to share more detailed information about which categories of bikes and P&A in particular are in the shortest supply, along with what retailers are predicting the future will hold.

In order to gather this more detailed information, rather than do our traditional How’s Business column where I talk to just six shops and ask two questions, for this month I decided to send out a more in depth survey, which was sent on Thursday 7th May.

I’d like to start by giving my most heartfelt ‘Thank-you!’ to everyone who completed this survey, for which there was no prize or other incentive of any kind other than to help your fellow bicycle retailers by sharing your story and opinions.

I gave all respondents the option of responding anonymously, which is fully respected, but most were happy to be named.

Most respondents gave some great insights when answering the final two questions. It was interesting to read such a wide range of opinions.

I’ll break the remainder of this article into two sections, summary data and selected individual comments.

Please note that this is not a statistically rigorous survey as we closed the survey once we reached 25 stores responding and there were no controls in relation to getting a proportional geographical spread of respondents across Australia.

However we got at least one respondent from every mainland Australian state plus the Northern Territory.

To answer one question that some readers may be asking, ‘Why would one retailer say they can’t get any stock of a particular bicycle category when others can?’ It may depend upon which brands each retailer is a dealer for and each wholesalers’ relative levels of stock.

Because of the sensitivities of wholesalers about sharing details of their stock levels, and because this can be worked out (at least to a degree) by looking at the brands that each dealer sells, I am not publishing the individual data for each dealer that responded.

You see fewer than 25 comments below because not every respondent chose to leave comments and I am also not publishing every comment that was made.

Summary Data

Do you currently have all the stock that you would like to have in your store?

Yes: 0%

No: 100%

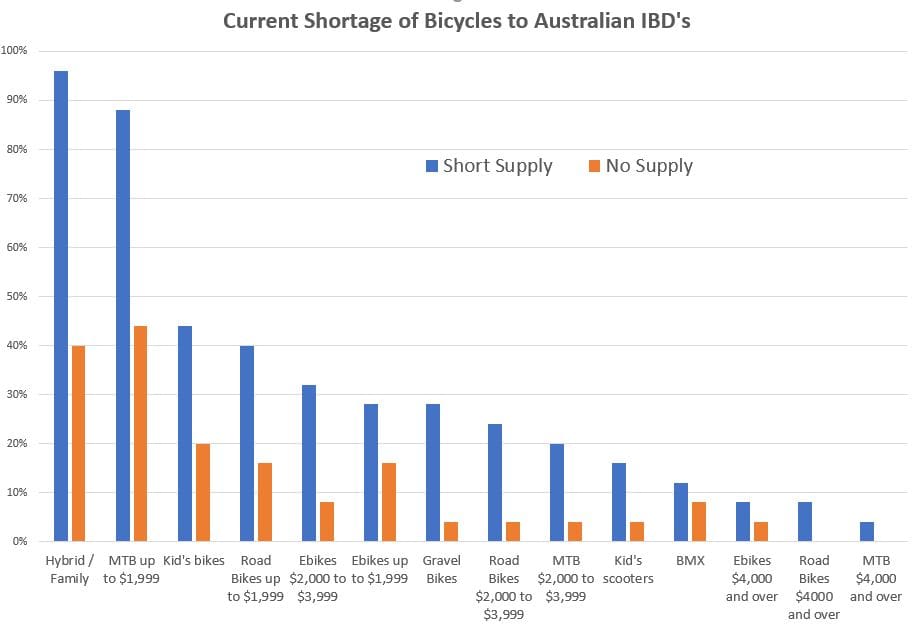

Which categories of bikes are you finding it hard to get replacement stock of?

Kid’s scooters: 16%

Kid’s bikes: 44%

BMX: 12%

Hybrid / Family: 96%

MTB up to $1,999: 88%

MTB $2,000 to $3,999: 20%

MTB $4,000 and over: 4%

Ebikes up to $1,999: 28%

Ebikes $2,000 to $3,999: 32%

Ebikes $4,000 and over: 8%

Road Bikes up to $1,999: 40%

Road Bikes $2,000 to $3,999: 24%

Road Bikes $4000 and over: 8%

Gravel Bikes: 28%

Are you unable to get any stock at all in any of these categories?

Kid’s scooters: 4%

Kid’s bikes: 20%

BMX: 8%

Hybrid / Family: 40%

MTB up to $1,999: 44%

MTB $2,000 to $3,999: 4%

MTB $4,000 and over: 0%

Ebikes up to $1,999: 16%

Ebikes $2,000 to $3,999: 8%

Ebikes $4,000 and over: 4%

Road Bikes up to $1,999: 16%

Road Bikes $2,000 to $3,999: 4%

Road Bikes $4000 and over: 0%

Gravel Bikes: 4%

Are there any categories of P&A for which you cannot get stock?

Yes: 100%

No: 0%

Please name the P&A categories for which you can’t get stock.

Several respondents gave a general answer such as ‘Many’, ‘Across the board’ etc.

Of those specific products that were mentioned by name, the categories that were mentioned most often in descending order from the top were:

Indoor Trainers

Tubes

Helmets

Baby seats/Kids seats

Lights

Tyres (with special mention of 26 inch tyres)

Kickstands

Pumps

Computers

Bottle Cages

Kids trailers

Chain cleaner

Energy gels

C02 cartridges

Gloves

Road Shoes

Saddles

Mobile phone mounts

Gabe Sullens from Urban Pedaler in the south eastern suburbs of Melbourne, Victoria said:

Future Supply Chain Predictions

I’m expecting a six month dip, with everything starting to return to meet demand within the six to12 month range. Demand on some categories like indoor trainers may take over a year to recover, or other categories where demand has increased while ability to produce has dipped.

General Comments:

I would expect a tsunami of product entering the market later in the year, a late response to the orders for product that are only being placed today in response to the increase in demand that we’re seeing now.

Some of it will hit the mark (smart trainers, entry-level bikes), but some might end up flooding the market 12-18 months from now when the demand dips and some level of normalcy returns.

I expect to see some big closeouts starting March 2021 along with holes in premium bike price points based on production problems.

There has also been a big interruption to bike parts supply. Companies that have laid off product managers who work on forecasting and parts orders to support their bike lines are going to find that the loss of expertise in the area caused them to miss the mark on items, so dealers will find themselves hunting the global market for bottom bracket parts, derailleur hangers, and other custom parts to support their sales. It’s going to trim a lot back from our ability to service bikes in the next two years.

This dealer who wished to remain anonymous said:

Future Supply Chain Predictions

Unsure! Possibly three months and up to six to 12 months before near to normal supply.

General Comments

I started with my usual strong stock holding and have had my showroom gutted three times over! I have turned over $320,000 in 4 weeks.

It has been horribly stressful, and both physically and emotionally demanding. I have managed to keep stock on the floor only via recourse to offsite contractors (retired shop owners) and a stood down aircraft engineer working casual (a customer I dragged off the floor when he bought a bike).

I made a late night call to a rep and ordered 150 bikes the night before most suppliers sold out in a day. I have around 350 bikes in stock with showroom now. I’ve been fluctuating between 80-90% full at all times.

I am possibly the only shop in my state with a complete range. I have set up referral sources at empty shops in other areas, and even though things have slowed a little I am still powering along as I am now the ‘last man standing’ in my area with stock on the floor.

The end financial result for me will be the equivalent of having sold the business, regardless of what stock or fixtures and fittings remain. A well-earned retirement looms imminent!

Even if I end up with no stock, I’m selling out all my stock now at full retail, which is a lot better than SAV (stock at valuation) when selling a business.

And even if I’m selling a business with little stock, I now have a much bigger customer base of new customers who will be coming back for servicing etc, so my goodwill value has gone up.

Just in the past few days (5th-8th May) we’ve noticed a quietening. But we’re still doing a week’s usual turnover for this time of year in a day.

At the peak in April I did $27,000 in one day. I had them queued 10 deep outside and 4 deep at the cash register.

One of my keys to having stock is that I’m a major account for a couple of second tier suppliers who have not been cleaned out quite so quickly. Any shop beholden to one or two suppliers would be in a tougher position.

We’re a family bike shop. Usually $1,300 would be the dizzy heights for us in terms of retail price point. During this period full retail price has become the new normal. ‘You don’t tell me what you’ll pay Mr Customer, I’ll tell you, because if you don’t take it, the next customer in line will. Usually my entry level bikes are around $499 but by the end of this weekend those bikes will be sold out and my remaining entry level stock will start at $799.

Stephen White from White’s Bikes in inner northern Melbourne shop that strongly focuses upon its workshop said.

Future Supply Chain Predictions

Switching suppliers seem to fill gaps but it leaves confusing story on the wall to explain to customers

General Comments

It seems as though with the slow summer selling season, many suppliers carried less stock and possibly cancelling end of season top ups. This leading into Corona left them short and unable to supply us, which subsequently has left us short and unable to meet all customer demand.

Leighton Thomas from Geraldton Bikes located on the coast approximately four hours north of Perth, WA said:

Future Supply Chain Predictions

I think it’ll be 6 months before suppliers have sufficient quantities in stock. Till then most popular bikes will need to be pre-ordered by customers and pre-ordered with suppliers.

General Comments

It’s an interesting time and I’m thoroughly enjoying the challenge of navigating the business through it. It’s also great to see customers making quick purchase decisions based on what’s available rather than getting bogged down with endless features, wheel sizes, styles, genders etc.

Hopefully the brands will consider simplifying product lines which will help defend against stock shortages happening in the future.

Mark Mannering from Bikes To Fit in Darwin, Northern Territory said:

Future Supply Chain Predictions

I’m not worried about trainers at all. There’s sufficient stock on hand and on the way to tide me over for a month (I hope).

General Comments

I was very fortunate to make a wise decision when China shut up shop in Feb. I took a gamble on a purchase of 150 bikes below $1000 retail expecting it to last me three months, not three weeks!

I can’t thank Advance Traders enough for helping me. That debt has been paid and I’ve ordered another $120,000 worth since. Actually I’m doing grouse and I commend every wholesaler that helps me along the way

Peter Sutton from The Complete Cycle in the outer southern coastal suburbs of Adelaide, South Australia said:

Future Supply Chain Predictions

Things should come back to normal in a couple of months

General Comments

No one could have anticipated enormous jump in demand for bicycles. I wonder what effect this will have on demand at Christmas?

Tony Russell from Wolves Bike Den half way between Brisbane and the Sunshine Coast in Queensland said:

Future Supply Chain Predictions

I think I’ll get replacement stock in two months.

General Comments

It’s great to see people out in family groups in the parks and trails

David Cannings from Bike Trax in Cessnock, a Hunter Valley town about two hours north of Sydney NSW said:

Future Supply Chain Predictions

I’ve seen slight delays but I’m sure factories are working overtime to be up to speed as soon as possible. It’s in their best interest as well.

Stuart Armstrong of Velo Cycles in the inner northern suburbs of Melbourne, Victoria said:

Future Supply Chain Predictions

Things will be delayed by a few months. I reckon Australia may get bumped to the back of the queue and have to wait for top up of stock and next year’s bikes etc.

General Comments

I am still surprised that some shops are still discounting bikes considerably when they can’t replace them and there is nothing comparable available.

Rob Sullivan of Rock and Road Cycles in Wangaratta, two hours north east of Melbourne, Victoria said:

Future Supply Chain Predictions

We will see a big dip in supply through May and June. We expect to see a small amount of bikes in June.

Josh Blake of Renegade Cycles in Lane Cove, a northern harbourside suburb of Sydney, NSW said:

Future Supply Chain Predictions

I think we’ll be waiting three to four months on bikes and one month for parts.

Chris Moore from Omafiets in the inner southern suburbs of Sydney, NSW said:

Future Supply Chain Predictions

I think we’ll have a gap of several months over winter before we can get more stock.

General Comments

It’s hard to know whether the bike boom will last!

Richard Hale from Cycling Mythology in Mildura, on the Murray River in far north west Victoria said:

Future Supply Chain Predictions

Most bike models not available until late August 2020. The situation highlights the problem of bicycle production having largely moved to China in recent years.

General Comments

It’s going to be a lean three months until most models become available again. Currently turning away a minimum of six enquires per day from customers seeking new bikes. The only good thing is that the bike shortage is going to line up with the winter months, which are usually quieter for us.

Mark Victor of Planet Cycles in the inner southern suburbs of Brisbane, Queensland said:

Future Supply Chain Predictions

Nobody really knows. Wholesalers know what they have on the water coming. But the in store, demand over the next few months is uncertain. If we continue to sell low end road, MTB and hybrid city bikes at our current rate, wholesalers won’t have enough bikes coming to meet demand. It’s all crystal ball stuff.

General Comments

The big question is as the Covid-19 and lockdowns (gym lockdowns) ramp up so did demand for bicycles. Does this mean as lockdowns (gyms reopening) ease or lockdowns are removed will we see the demand for bicycles fall away?

Is the bike industry on a curve now as well?

And are we all in for a quieter summer?

I think we are as I think bicycle demand will fall away as lockdowns are eased or removed. What goes up must come down.

Mickey Boulton from Fleet Cycles Mandurah on the coast one hour south of Perth, WA said:

Future Supply Chain Predictions

It is a poorly timed windfall… (due to lack of stock)

But great we got to sell through a bunch of bikes in a time we would be preparing for a hard winter of slower sales…

General Comments

In 20 years I have never seen sales growth and interest this strong… bring on the next pandemic, just can the next one start in October when supply is ready?

I hope we have created enough interest in a generation of kids to carry our sport forward with fond family memories of, ‘That time we all rode bikes as a family!’

I hope someone or some government body can get the cycling bug and start a local promotion of where newer riders can enjoy riding – where to do it is half the key to keeping them engaged…

Peter Emery from Georges Bike Shop in the northern Perth suburb of Balcatta, WA said:

Future Supply Chain Predictions

I think it will be four to six weeks’ delay in getting more stock.

Dave Phillips of Pedal Power Gympie, 160 km north of Brisbane, Queensland said:

Future Supply Chain Predictions

Bikes, you just can’t go without. The first 2021 stock is landing in two weeks, but how will the distributor ensure fair distribution?

General Comments

It has been Christmas in April, but Christmas is/was now a fizzer. I’m putting in my best effort for Black Friday 2021, (sale day on after Thanksgiving Day) much as I despise yank stuff…

Anna Bull from My Ride Kalgoorlie, the outback mining town in Western Australia said:

Future Supply Chain Predictions

It is a matter of being patient and waiting until the non-stock items become available. Lots of old bikes that have been sitting for years in sheds have been resurrected and this has meant parts and accessories like tubes and tyres have been in very high demand.

General Comments

It is great to see so many people out on their bikes. Hopefully once this pandemic is resolved people will continue riding and possibly buying new bikes because they have discovered the joy of riding!

Dave Griffiths from Bike Force Joondalup in the northern suburbs of Perth, WA said:

Future Supply Chain Predictions

With the bikes (hybrid and MTB) under $699 we will be missing stock for four to six weeks and some brands I think up to three months.

General Comments

It is a better problem than having too much stock 🙂

Innes Fenton of Bspoke Bicycles in the NSW town of Bungendore which is within commuting distance of Canberra, ACT said:

Future Supply Chain Predictions

Appears on average shipments are due around July however uncertain about what quantities will be available.

General Comments

Although we have experienced significant growth over the past months, we forecast a post Covid-19 downturn during winter & spring due to restricted supply chains.

Sequoia Frahn of Baw Baw Cycles in the eastern Victorian town of Warrigal said:

Future Supply Chain Predictions

I predict three to four months at this stage on most products.

General Comments

Consumers are all keen to get riding but need servicing.