Bicycle Imports in Freefall but Unit Value Soars

Canberra, ACT

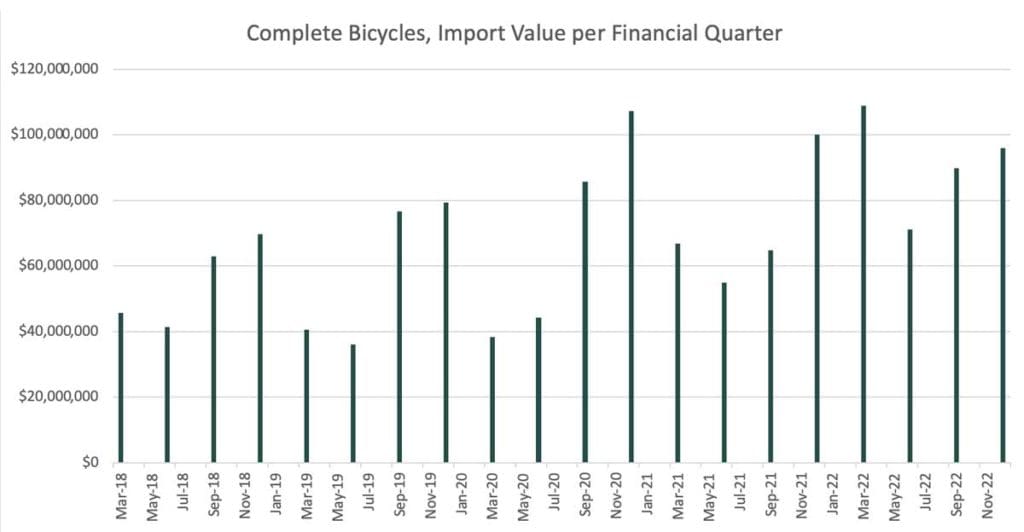

Bicycle import numbers in Australia were on an earthbound trajectory when The Latz Report last reported on the data late last year.

My article on the data to the end of September 2022 reported: “It appears that after two years of stratospheric bicycle imports, numbers are starting to fall back to earth.”

One quarter on, there’s no question that import numbers are in freefall. The question now is: “Will the cord be pulled in time for the parachute to open, or will there be an overcorrection that gives our industry a hard landing?”

Let’s look at the data more closely.

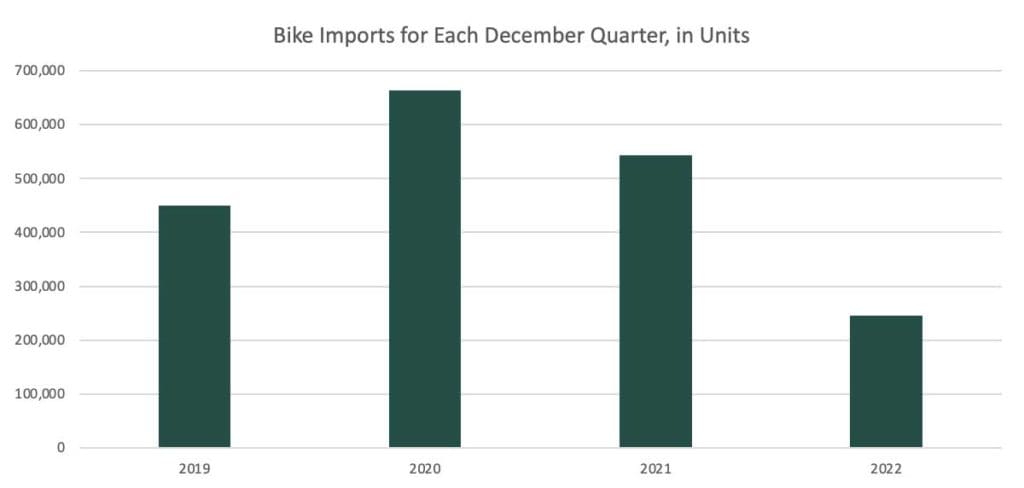

For the December quarter, total bike imports into Australia were 245,666 units.

By comparison, in November 2020 – at the peak of the Covid demand boom – slightly more bikes were imported in a single month than in the three months of the quarter ended December 31st 2022.

Comparing quarter on quarter for the previous three years …

- December quarter 2019: 449,851 units

- December quarter 2020: 663,380 units

- December quarter 2021: 543,884 units

“By far the lowest December monthly total in 14 years of available data.”

In summary, the latest December quarter is not only well under half of bicycle imports during each of the two December quarters when Covid dominated the headlines. It is also 204,185 units lower than the pattern in 2019, which was a typical pre-Covid year.

Even with such a low total, there was a further slowing within the December 2022 quarter as it progressed. A total of 105,914 bikes were imported in October, 85,230 in November and just 54,522 in December. That is the by far the lowest December monthly total in 14 years of available data.

Within the December data, 11,965 children’s bikes were imported and 42,557 adult bikes. The adult bike total is certainly low, but the children’s bike number is even further below average. In fact, it’s the lowest monthly total for children’s bikes for any time of year since January 2010.

Depending upon how long the bike import reduction trend continues, the 2022/2023 financial year is on track to be the first year totalling below a million units for about two decades.

Volume Down but Unit Value Way Up

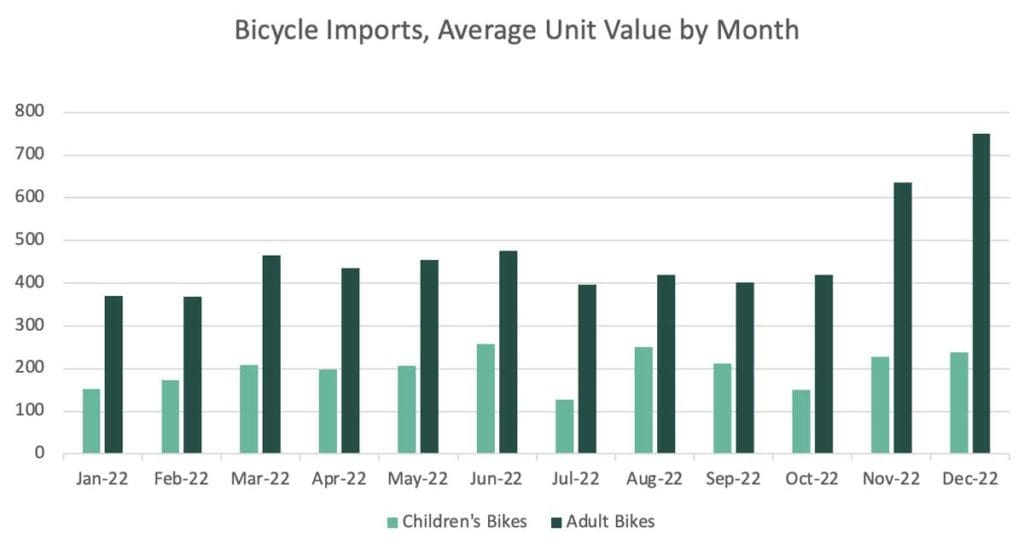

Meanwhile, the average unit value of bikes imported hit an all-time high for the December 2022 quarter.

The average value of children’s bikes imported was $194.05. That is well up on the previous record, set in the September 2022 quarter, and double the typical unit value range of the previous decade, which usually fluctuated between $90 and $100.

For adult bikes, the average unit value for the December quarter was $446.61 which was more than $100 up on the September 2022 quarter’s previous record and compares to the typical range of the previous decade of $260 to $310. The monthly figures within the December quarter show an even more dramatic increase, as the chart below shows. But monthly figures are more volatile, so we need to wait to confirm the scale of any long-term trends before getting too excited about the spike in December 2022.

What’s causing this huge increase in average unit value? While I don’t pretend to know the exact answer and all of the following is based upon anecdotal evidence rather than hard data, it’s probably a combination of at least four factors.

Firstly, shops are reporting that demand is softest for low-end adult bikes and children’s bikes. Demand still seems relatively normal (by pre-Covid standards) for mid to high-end bikes, so it stands to reason that importers would be turning off the taps on children’s and low-end adult bikes just as hard as they can.

Mid to high-end bikes have been the last models for global production to catch up with global demand, particularly certain road, gravel and e-bikes. Even now, there are still some shortages of certain components, so the relative proportions of low to mid and high-end bikes imported might be distorted while the higher-end bikes catch back up.

Thirdly, global manufacturers increased prices quite significantly in 2022. It’s too early to say how far manufacturers’ prices may retreat, if at all, now the global bike industry is seeing reduced demand.

Finally, it’s quite likely e-bikes are continuing to comprise a growing proportion of bike imports, which will put upward pressure on the average unit import value, given they are typically a higher value compared to regular bikes.

Whatever the mix of these and other reasons, if the average unit value continues at December quarter levels, the financial year could finish well up on pre-Covid years in terms of total value of bike imports and even close to the total value of each of the two Covid boom years. This is despite the number of units looking likely to finish the current financial year well down.