Bicycle Imports Remain Below Average

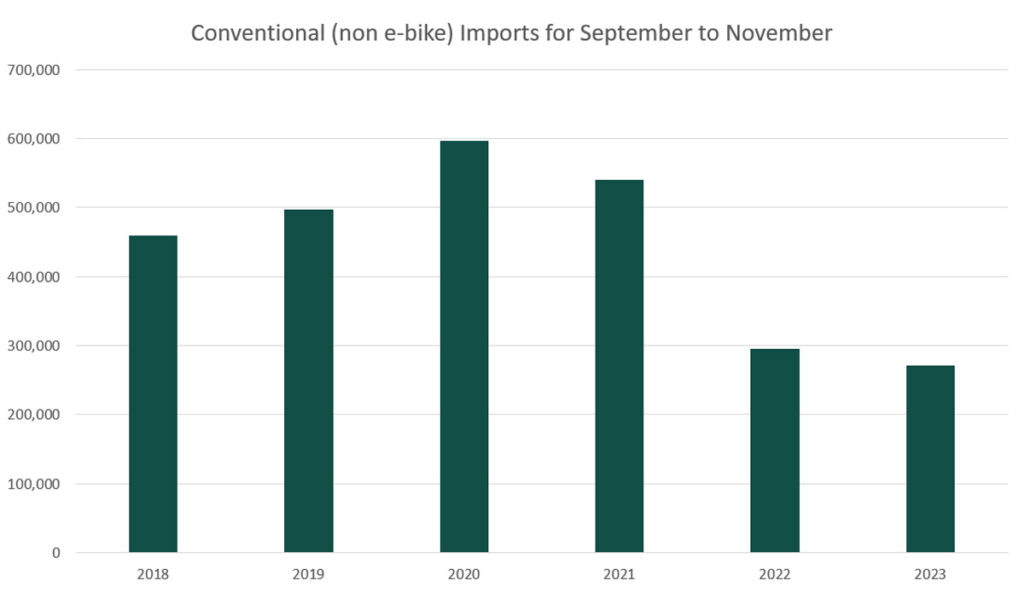

Bicycle import data for September to November 2023 has now been released. These are traditionally peak months for import volumes, as wholesalers land their Christmas / summer season stocks. And although the monthly numbers are up compared to the previous 10 months, compared to the corresponding months in previous years, numbers are still well down, even when compared to pre-covid years.

In total 270,515 conventional (non-electric) bicycles were imported for this three month period.

This was broken down as September 74,219, October 102,465 and November 93,831.

October was the first month over 100,000 units since October 2022. But in past years, before the covid boom, it has not been uncommon for October to be either just under or just over 200,000 units.

Looking at comparisons for the corresponding three months of September to November in the previous five years the numbers were:

| 2018 | 459,189 |

| 2019 | 496,552 |

| 2020 | 596,868 |

| 2021 | 540,659 |

| 2022 | 295,295 |

| 2023 | 270,515 |

Here is a chart showing this data:

As you can see from the data table and chart, 2023 saw a leveling out of the large drop that occurred in 2022. November 2023 imports actually exceeded November 2022 imports. This is the first month where we’ve seen a year on year increase for any month in 21 months. The last time this happened was when February 2022 exceeded February 2021. So perhaps we are starting to see the bottom of the ‘J curve’, but of course, it’s too early to say that conclusively.

The data is broken down into Adult Bicycles and Kids’ Bicycles. The proportion of adult bicycles has been just 50.83% for the first five months of the current financial year. This is well below its typical range of between 60% and 70%.

Overall, the drop in imports is still stark. For the first 11 months of the 2023 calendar year, a total of 627,200 non-e-bikes have been imported. That’s the first time this 11 month number has been below one million units since 2011, when it was 988,189. Back then Australia’s population was only 22.3 million. Today it’s 26.6 million, so the per capita drop in bike imports is even larger, although e-bike imports, which are reported separately and additional to these totals, were virtually nothing in 2011, but now add several hundred thousand units of higher value bikes per year to our industry.

E-Bike Imports Also Down

At the time of writing, we only have e-bike import figures until the end of October. As we have explained previously, because this customs code includes e-motorbikes of various styles, we are currently taking 90% of this figure to represent e-bicycles.

Looking at this adjusted number, there were 22,661 e-bikes imported in September 2023 and 20,819 in October. This compares to 34,268 and 38,637 for those months in 2022.

In total 223,509 ebikes were imported for the first 10 months of calendar year 2023, which if the trend continues once we see November and December will mean a 12 month total for the calendar year of 268,210 units. At the peak of covid, e-bike imports were running at over 400,000 units per 12 month period, so the volume of imports has dropped significantly.

Unit Values are Also Down

As we have reported in several of our most recent import data reports, the average unit value at FOB (free on board ie the price from the manufacturer before freight, duties, wholesale and retail markups) is also recorded and has been dramatically higher post covid – until now.

For example, for conventional bikes every financial year from 2014/15 to 2020/21 the FOB import value sat within a very narrow band from $203 to $237. As covid shortages hit it rose in 2021/22 to $271, but then skyrocketed to $446 for 2022/23.

We speculated that a large reason for this increase was a temporary distortion in the mix of bikes being imported into Australia. In summary, we had severe overstocks of kids’ and low end adult bikes, but still shortages of high end bikes. Therefore as a proportion, more high end bikes have been imported than normal, since covid.

The average FOB unit value for conventional bikes now appears to be heading back down. For the first four months of the current financial year, July to October 2023, the average unit value was $325. The higher proportion of kids’ bikes being imported during these months would also be impacting these figures as they are usually of lower unit value.

The average FOB unit value for e-bikes has also dropped from $980 in 2022/23 to $830 for the first four months of the current financial year.