Our First Look at Parts & Accessories Import Data

Canberra, ACT

Occasionally over the years when reporting on the latest bicycle import data, I’ve made passing references to P&A data, but this is the first time that we’ve taken a deeper look at the data that’s available.

In addition to collecting specific data on complete bicycles, Australian Border Force also has tariff codes for eight different categories of P&A, which I will list below. When looking down this list you will see that some high turnover categories are missing, such as helmets, locks and pumps.

The problem is that certain products are lumped in with other industries, so that it’s not possible to extract bicycle industry specific data. For example, under helmets there are two categories which can be summarised as ‘motorcycle’ and ‘everything else’. Because there are so many other uses for helmets such as industrial, equestrian, skating and more, it’s problematic to try and guess how many of that ‘everything else’ helmet code would be bicycle helmets.

Apparently, it’s extremely difficult to persuade Border Force to add more tariff codes, as their policy is actually to reduce the total number. So unfortunately, we won’t have data for bicycle helmets or other categories not listed below any time soon.

Within the eight categories for which data is recorded, only four of them show unit cost, quantity and total cost. The others only show total cost.

As you will see there are 10 codes and we only have data for eight of these. We’re trying to ascertain why we haven’t seen any data for brakes and hubs when there are codes for these.

Here are the 10 codes with their specific descriptions:

4011500013

New pneumatic rubber tyres, of a kind used on bicycles

4013200002

Rubber inner tubes of a kind used on bicycles

8512100032

Lighting or visual signalling equipment of a kind used on bicycles (excl. electric filament, sealed beam lamp units, ultra-violet, discharged/infra-red/arc lamps)

8714910044

Frames for bicycles and other cycles (including delivery tricycles) (excluding for motorcycles, mopeds and invalid carriages)

8714910048

Forks, parts of frames and forks for bicycles and other cycles (including delivery tricycles) (excluding for motorcycles, mopeds and invalid carriages)

8714920007

Wheel rims and spokes for bicycles, other cycles (including delivery tricycles) and for side-cars (excluding for motorcycles, mopeds and invalid carriages)

8714930008

Hubs (excluding coaster braking hubs and hub brakes) and free-wheel sprocket-wheels for bicycles and other cycles (including delivery tricycles) and for side-cars (excluding for motorcycles, mopeds and invalid carriages)

8714940009

Brakes, including coaster braking hubs and hub brakes and parts thereof, for bicycles and other cycles (including delivery tricycles) and for side-cars (excluding hubs)

8714950010

Saddles for bicycles and other cycles (including delivery tricycles) and for side-cars (excluding for motorcycles, mopeds and invalid carriages)

8714960011

Pedals and crank-gear and parts thereof for bicycles and other cycles (including delivery tricycles) (excluding for motorcycles, mopeds and invalid carriages)

Summary of Data by P&A Category

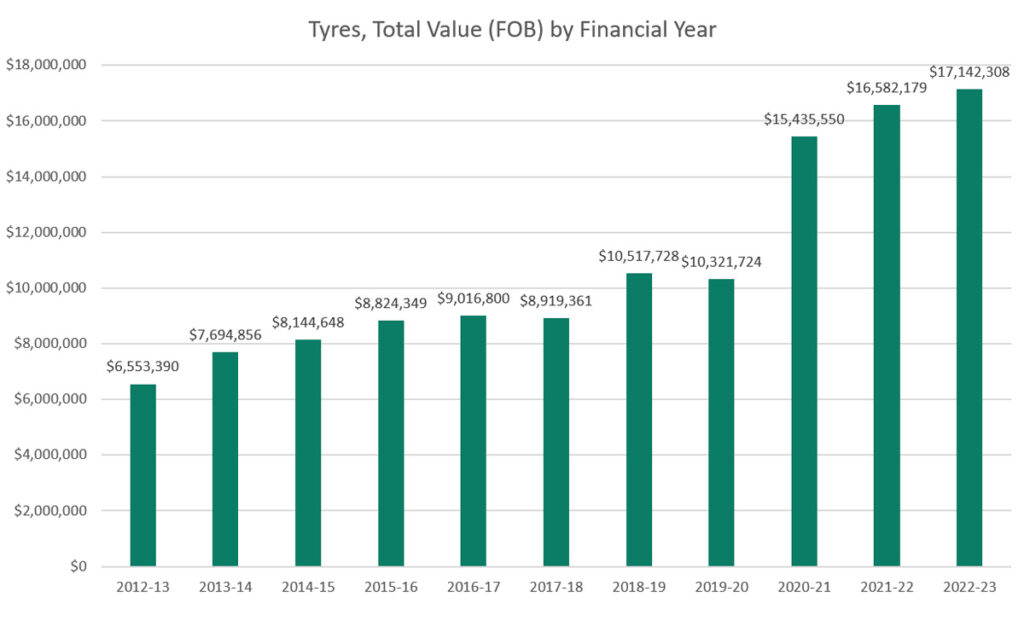

Before looking at each of the eight P&A categories, as a general comment, you might think that some of the total values for certain categories are very low, given that these numbers cover the entire Australian bicycle market. But please bear in mind that these are all at FOB (free on board) prices, which is what the importer pays to the manufacturer before any charges are added. To get to the retail price you need to add the importers’ freight, tax and other import charges, then add their wholesale margin, then add the retail margin and finally GST.

On some P&A items, especially ‘bread and butter’ lines of tyres and tubes, both wholesaler and retailer can be marking up the products by 100% (ie 50% gross margin) or more, which means $1 becomes $2 and then $4. By the time you add in all of the other costs, it’s not unreasonable to estimate that $10 million of tyres or tubes at FOB could end up being $50 million at retail. Margins on some of the other categories are lower, but still higher than for complete bicycles.

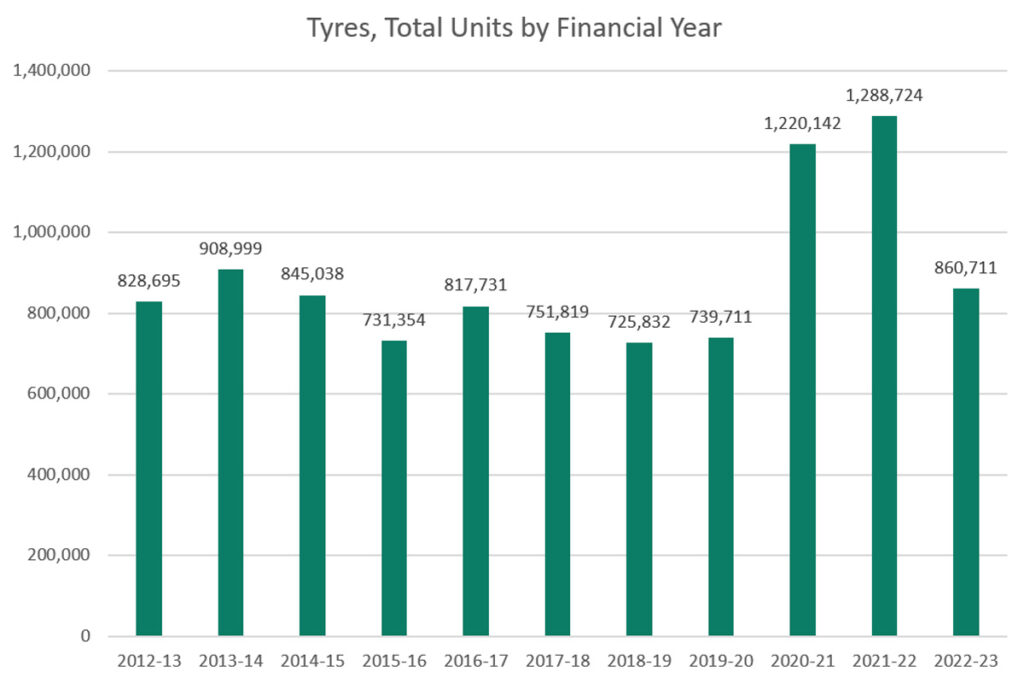

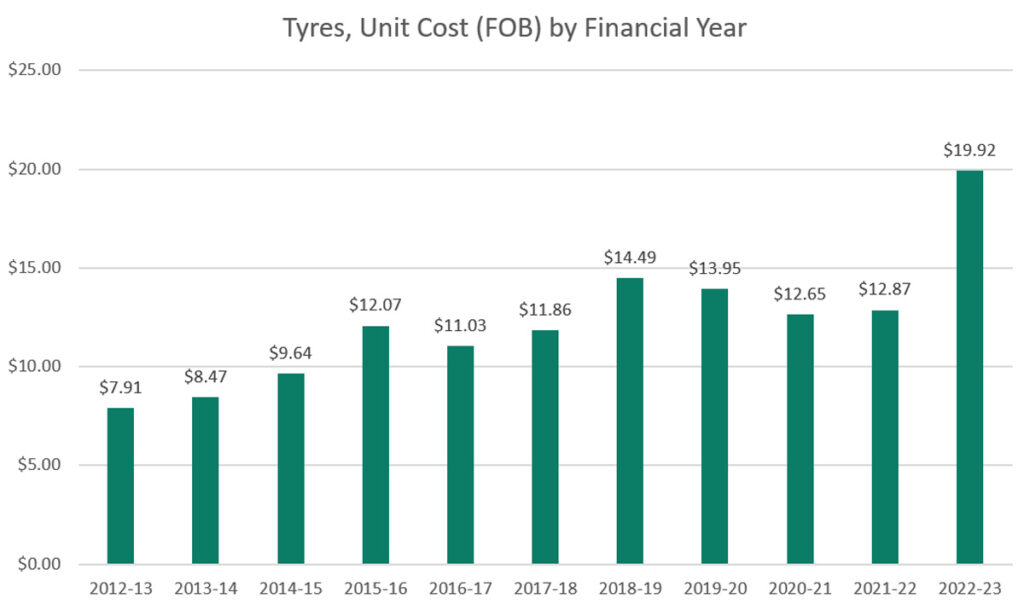

Tyres

By Units, Tyres track a path that you might expect with a two year covid spike and then returning to pre-covid levels. However, by unit cost, tyres saw a huge spike after covid for the 2022-23 financial year which meant that their total value for 2022-23 was a record $17,142,308.

For the first two months of the current financial year that price spike is continuing with a unit cost of $21.30 in July and $26.68 in August 2023.

Tubes

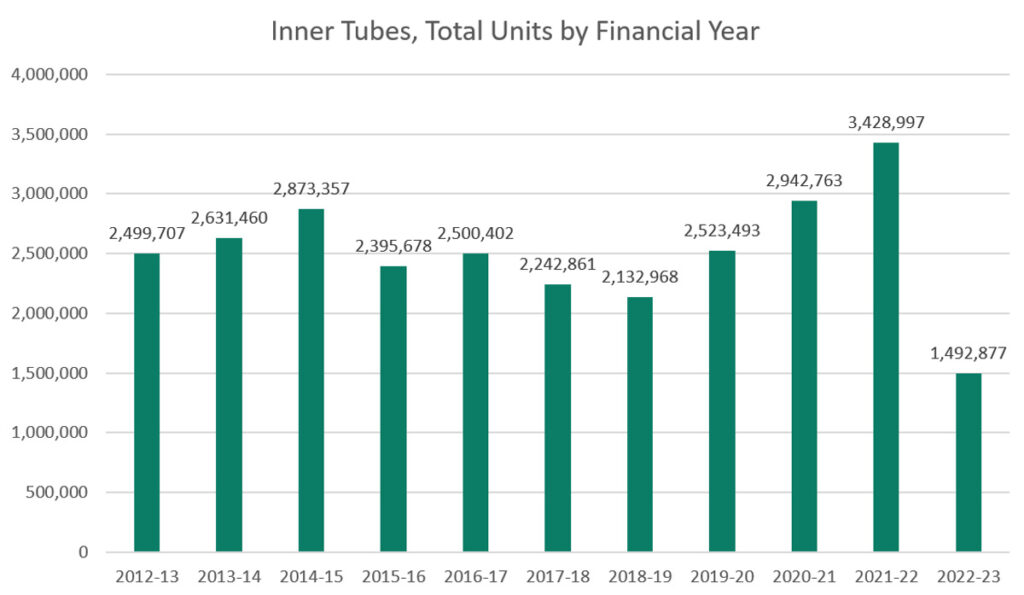

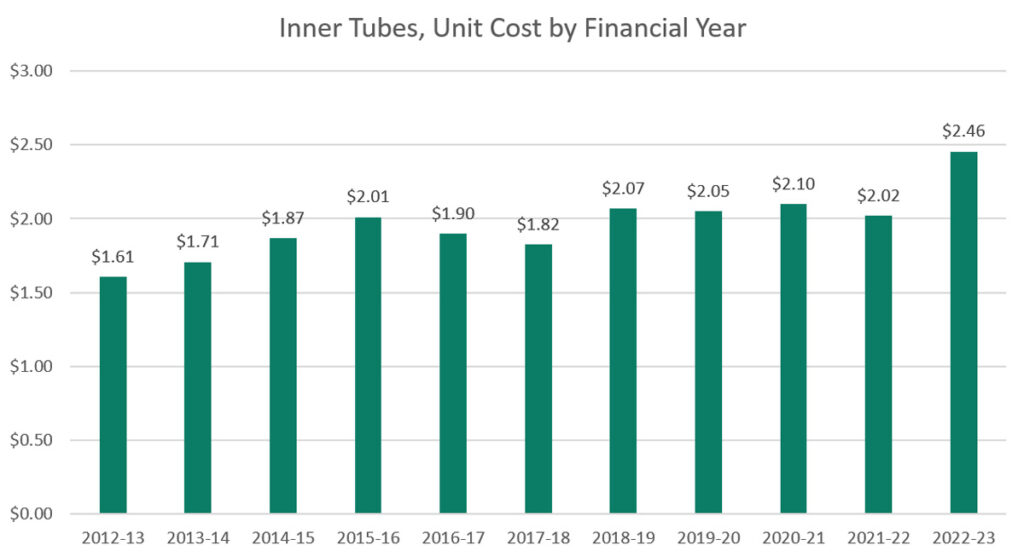

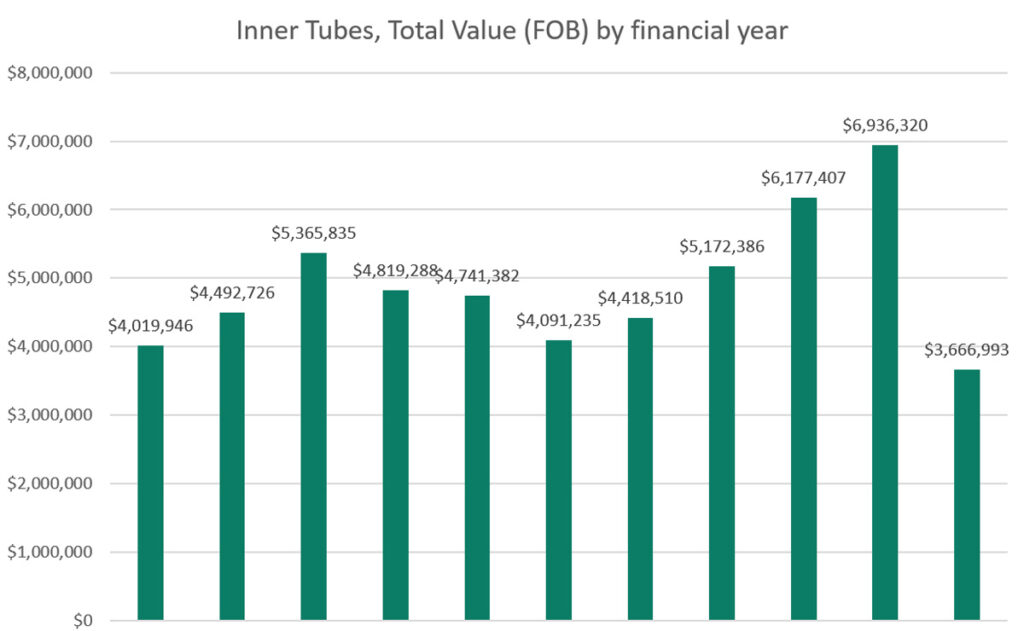

By units, tubes have seen a much bigger post-covid drop than tyres, dropping to well below pre-covid levels.

The unit cost of tubes has been more stable, so the total import value has also dropped sharply in 2022-23

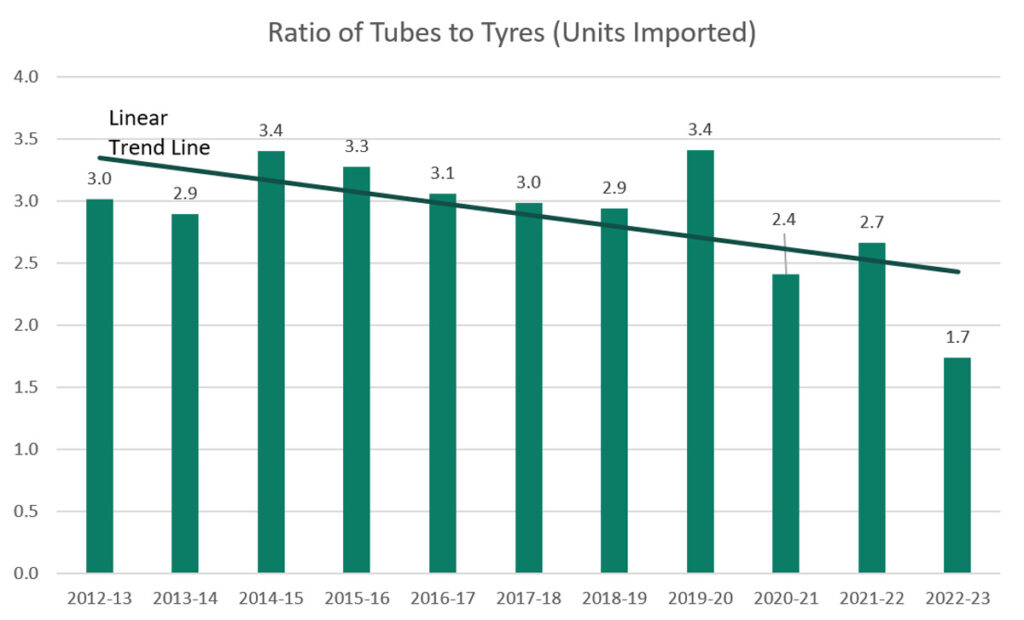

Given that we have 11 years of data available for both tyres and tubes, I thought it would be interesting to plot the ratio of tubes to tyres.

Because tubeless tyres have become more popular over the past decade, first for mountain bikes and more recently for road and other bikes, you would expect to see a downward trend in this ratio, but probably not that steep, because lower priced bikes in all categories still predominantly use tubes.

Sure enough, the data does show a drop in the ratio of tubes to tyres, but if 2022-23 had not been such a low year for tube imports, the trend line’s downward slope would have been less steep. Of course, the trend towards tubeless tyres might not be the sole reason, why this ratio has dropped. For example, if new puncture proof technology for both tyres and tubes has made tubes last longer, then less replacement tubes would be needed.

Lights

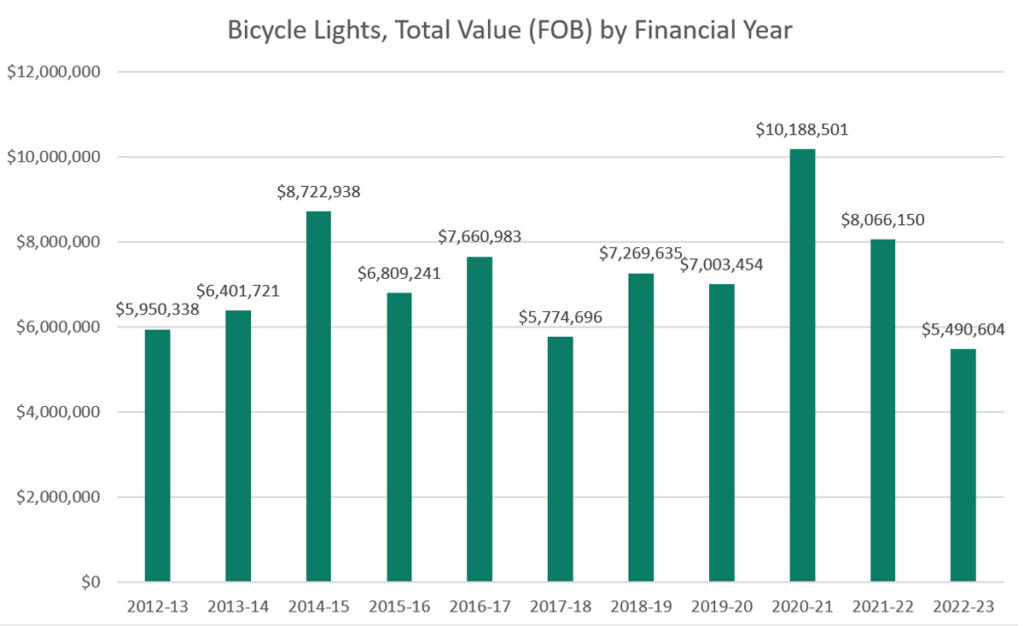

Imports of lights saw a smaller covid spike. Perhaps this was because many of the new covid customers were casual recreational cyclists who were not interested in riding at night.

Imports have returned to slightly below pre-covid levels suggesting a stock overhang from the covid years.

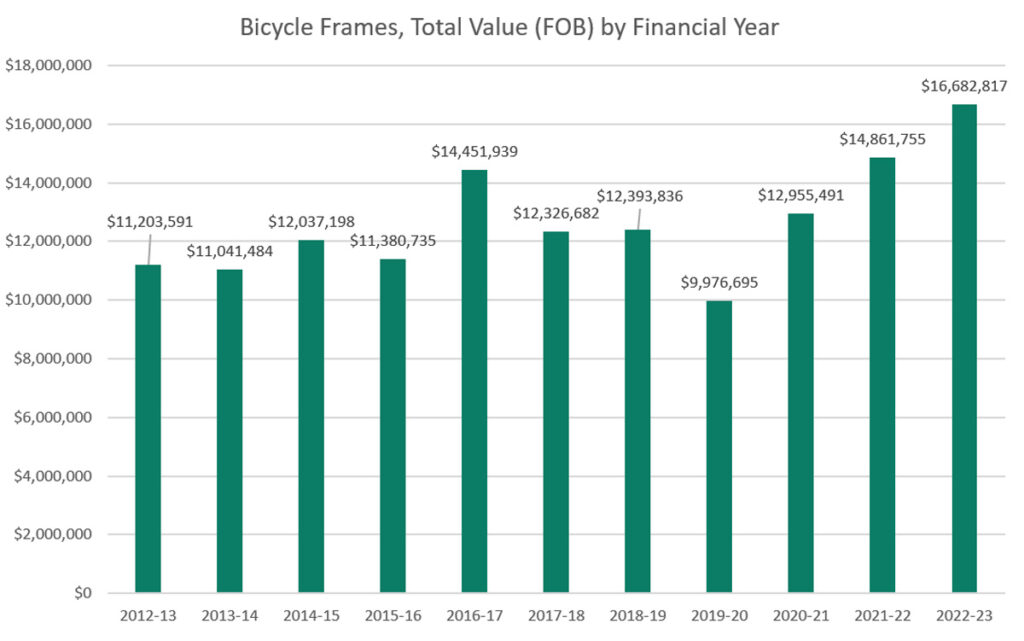

Frames

It would be interesting to know the break-down of this category between road, mountain, gravel etc. Most of these frames would be higher end products that are individually built to order into complete bikes either by retailers or customers. As I understand it, some bicycle importers import a small number of bare frames with each batch of bikes, to be used as warranty replacements, although a couple I asked about this don’t do this at all.

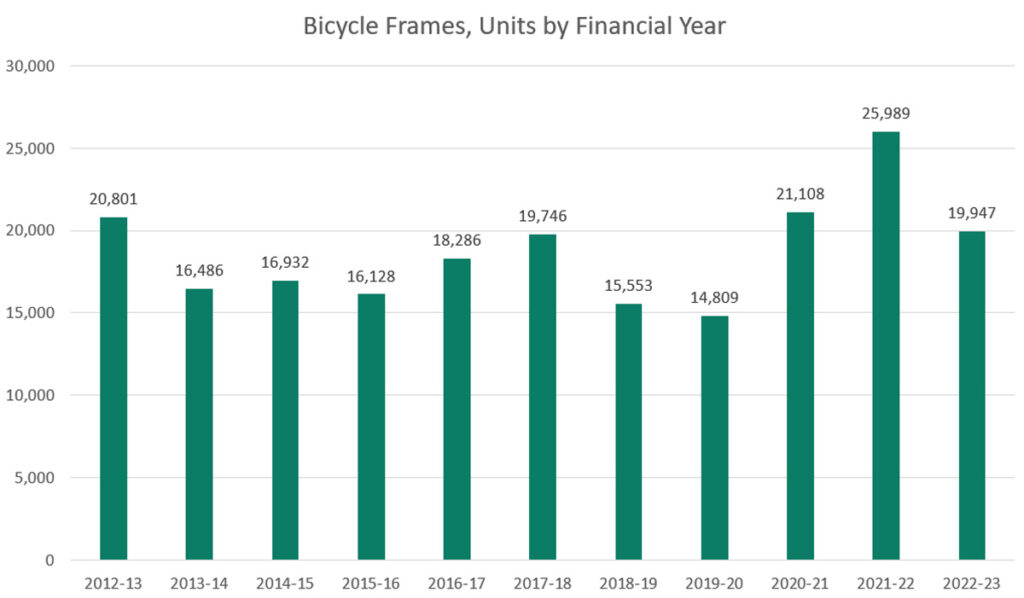

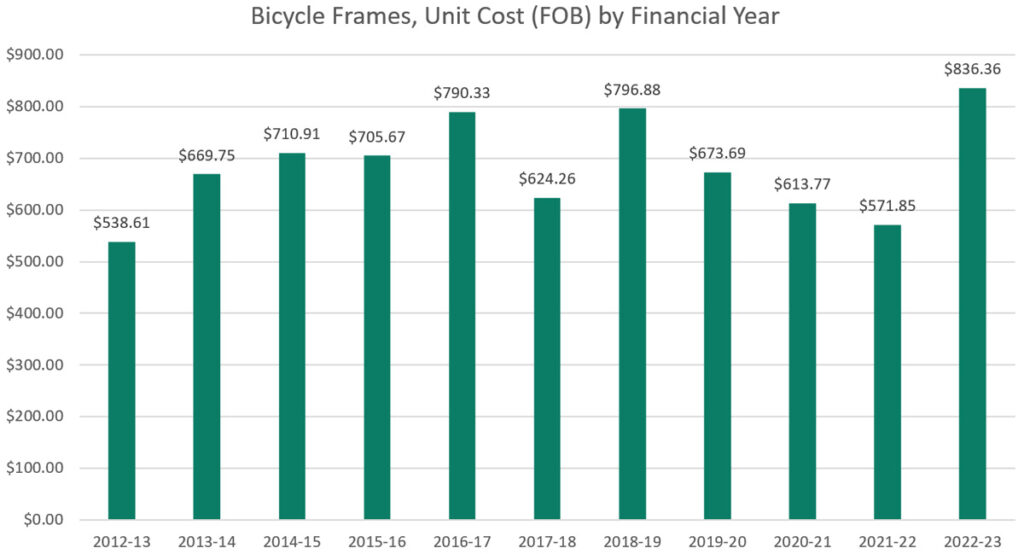

Frame quantities saw a slight covid spike in quantity and large drop for 2022-23. But a huge increase in unit cost in 2022-23 meant that total frame import value was at a record level that year.

This higher unit value trend has continued for the first two months of 2023-24 with the average unit cost over July and August being $982.44. These months are not shown in the charts.

Forks

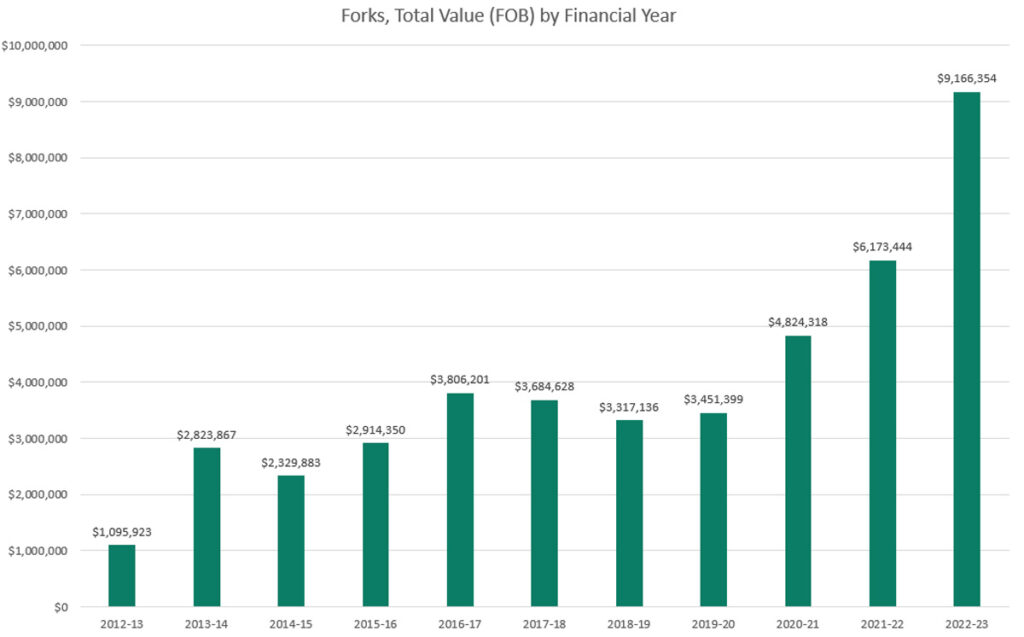

I would imagine the MTB suspension forks would comprise the bulk of value in this code, with upgrades to road and gravel forks being a smaller element.

Unfortunately, we don’t have data on units and unit cost for this category, only the total value, which soared to record levels for the 2022-23 financial year.

In the first two months of 2023-24 imports have dropped back to an average of $480,066 per month, which would equate to $5,856,792 if that trend continues for the rest of the year. This is still up every year apart from the past two.

I’m thinking that the growth in aftermarket fork imports is mainly due to the increasing popularity of mountain biking, particularly as new trails and mountain bike parks are being built throughout Australia. But if you’re an importer who knows more, please write in the comments below!

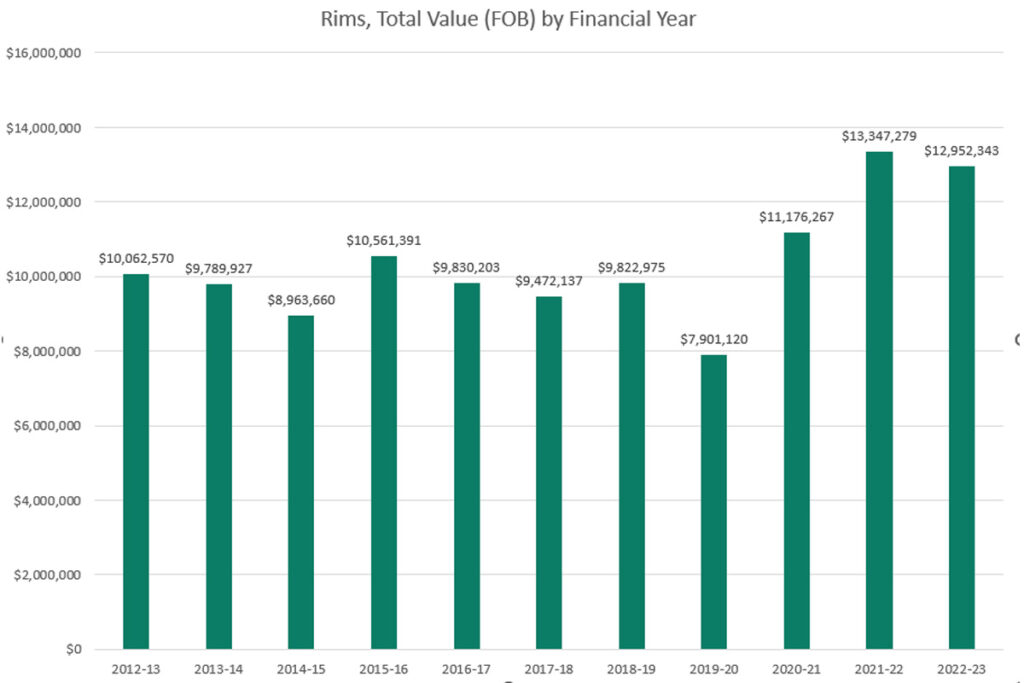

Rims

Rim imports have been the most consistent of any of the categories.

From conversations with P&A wholesalers rims was a product category in particularly short supply during covid, which probably helped to flatten the spike in numbers. This was possibly because rim manufacturers priorities their production for OEM customers (ie the bike manufacturers) rather than the smaller after-market customers.

Rims are imported for building upgrade or replacement wheels which are built by specialist wheel builders, many bike shops and some consumers.

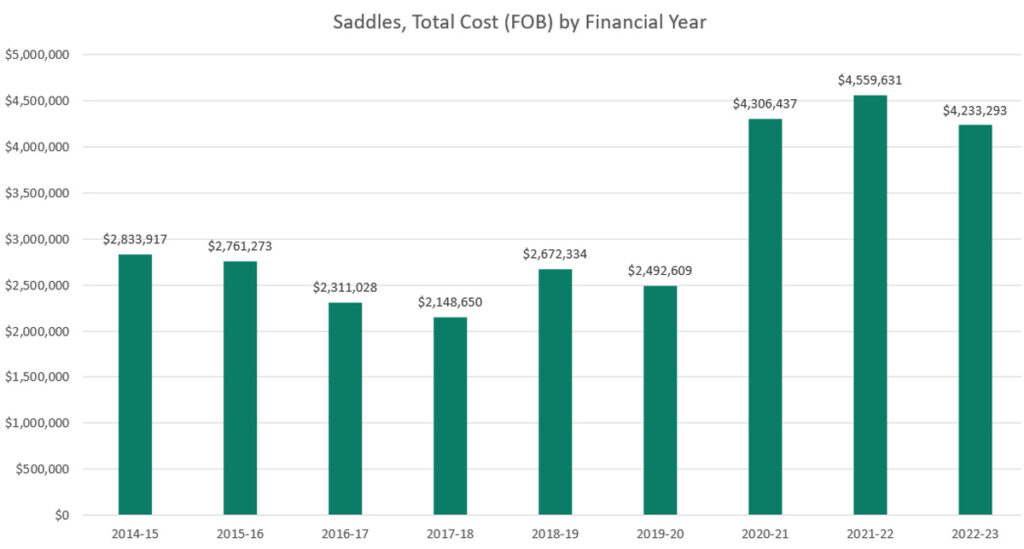

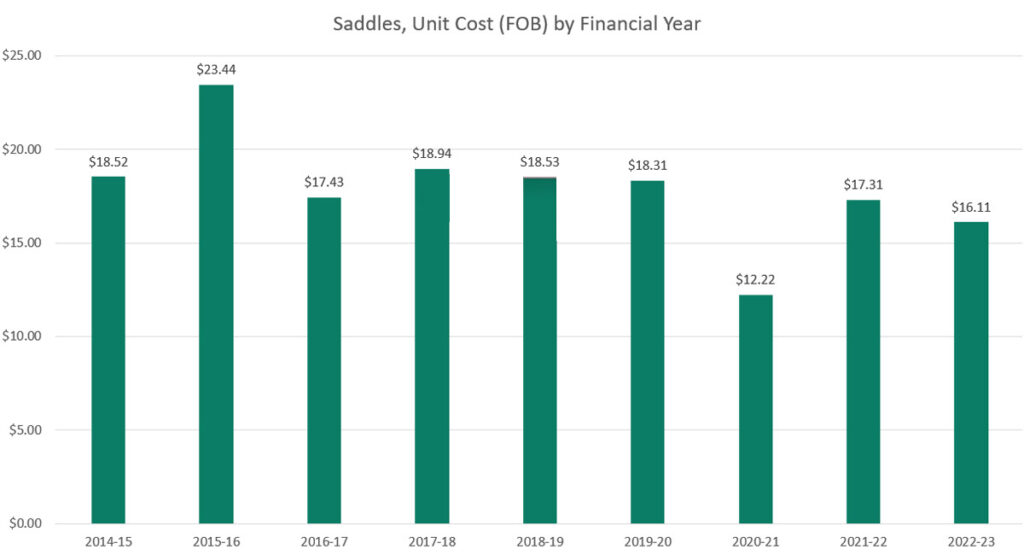

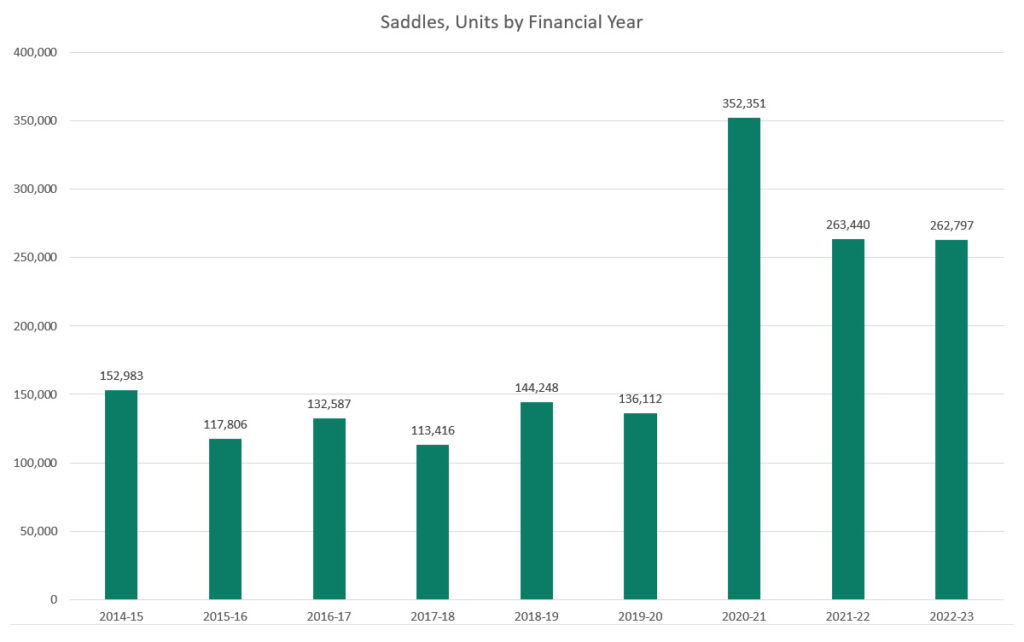

Saddles

The number of saddles imported saw a huge spike during covid, which did not return to pre-covid levels in 2022/23. However, the monthly import numbers were falling during that year and that downward trend has continued for the first two months of 2023-24 and heading for a more typical pre-covid total.

Saddles are one of the few items that appear to be trending down in terms of unit cost.

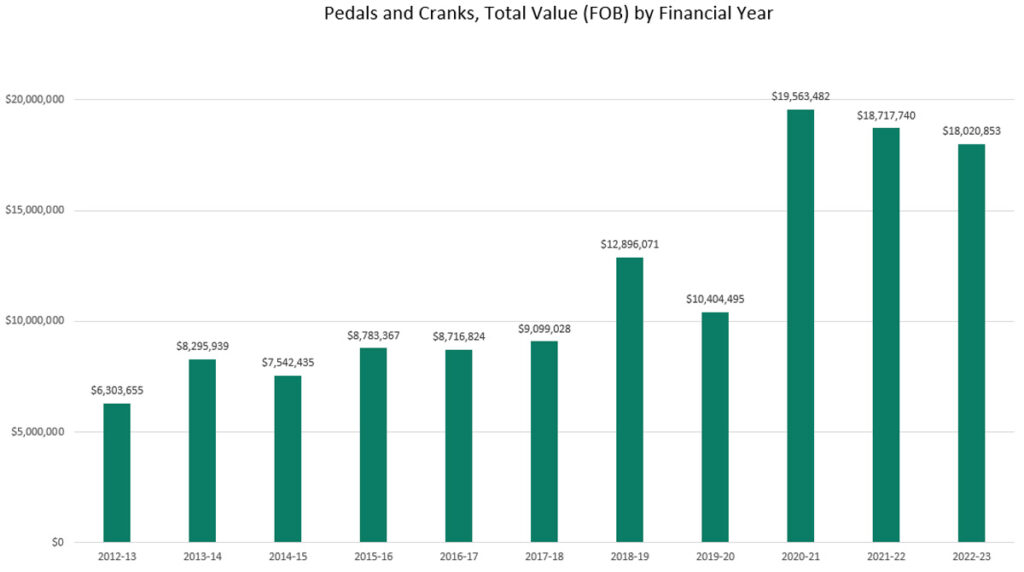

Pedals and Cranks

This is one of the biggest ticket P&A categories in terms of total value per year imported.

Presumably, most importers include bottom brackets within this code, which being relatively high stressed, wearing parts, might explain the high value, along with the relatively high unit prices for both pedal and crank upgrades that consumers may buy for higher end bikes. Pedals and cranks that incorporate power meters would also help to increase the value.

Once again, we’ve seen a huge covid increase and only a slight decline in 2022-23. The first two months of 2023-24 totalled $1,721,961 and if this trend continues the year total will be around $10 million which will put it back in line with pre-covid years.

Conclusions

As I wrote in the introduction, this is the first time we’ve dived into the import data for P&A. If you’d like to see updates in future, then please write a comment below or contact me directly.

If you have any insights as to why certain data is trending as it is, or about P&A imports in general, we’d love to hear from you. I’d specifically like to thank John Dunnachie of Bikecorp, one of the largest P&A importers in Australia, for previewing charts and giving background comments.

Although the total values of these P&A categories are far lower than for complete bicycles and e-bikes, P&A will always remain an important part of our industry. Retailers usually enjoy higher margins on P&A, they can achieve higher profits per square metre of shop space, which is particularly important in high rent stores.

P&A also keeps retailers’ sales ticking over in tough times when complete bike sales are subdued or there is heavy discounting. Due to a combination of factors, it seems that bike shops have successfully carved back some market share, or at least held their ground against specialist online mail order competitors, so P&A looks set to remain important to bicycle stores for years to come.