European Bike Sales Down, But Far from Out!

Frankfurt, Germany

As you would expect, there was a lot of talk at Eurobike about the post-covid boom downturn in the bicycle industry, just as there has been in Australia.

But rather than just base articles on subjective conversations I’m always keen to ask, “What does the data say?”

The following article is based on data sourced from Bike Europe and the Eurobike Show Daily. In turn, they have sourced their data from the various national bicycle industry associations for the respective European countries.

All reports are for complete bicycle sales only, combining both e-bike sales and analogue bike sales, but excluding P&A sales etc.

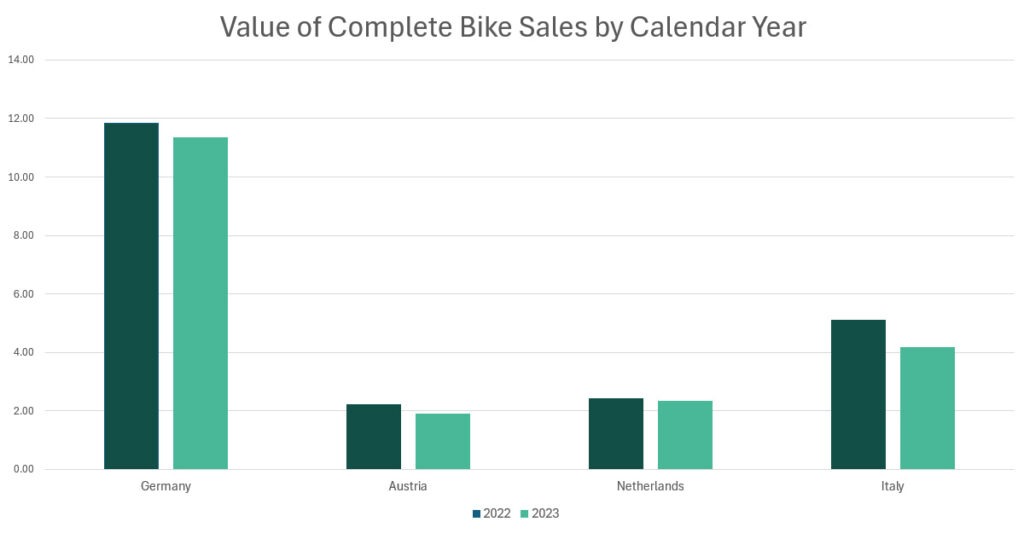

Unfortunately, not all reports show the value of bicycle sales. Some just give the number of units sold. Therefore, I’m only able to compile an “apples for apples” comparison chart for four countries, but will give a brief summary for a larger group of countries.

All of the figures are comparing the 2022 and 2023 calendar years, that is from 1st Jan to 31st December each year.

Megatrends

Sales in almost every European country listed here, for both e-bikes and analogue bikes, were down in 2023 both by volume and total value, when compared to 2022.

But this is not quite as catastrophic as it may sound, for the following reasons.

Firstly 2022 was a big year, in the case of some countries a record year, due to covid sales still boosting numbers – for at least the first part of the year before the post covid slump began. When comparing 2023 to pre-covid 2019, in most European countries, sales are up.

Secondly, over recent years the product mix has been shifting towards a higher percentage of e-bikes vs lower percentage of analogue bikes. Because e-bikes on average have a much higher unit value, total sales values for 2023 have fallen by a smaller percentage than total sales volumes. In other words, the industry is turning over almost as much money as before but selling a smaller volume of bikes.

For example, please refer to the chart accompanying this article which shows the sales in Australian dollars (converted from Euros at 1.61 which was the exchange rate on the day of writing this article). You will see that all four countries shown are down, but in total their sales of complete bicycles (measured at retail value) only dropped 8.3% from A$21.6 billion to A$19.8 billion.

If anecdotal evidence from recent Asian bicycle export figures and discussions at Eurobike are anything to go by, it’s quite possible that sales will drop further for 2024. But many at the show were tipping a turnaround, either in 2025 or 2026. Until then, optimism doesn’t pay the bills only the best managed companies will survive.

Brief Summary by Country

I’ll now give a brief summary of information for some European countries, sorted by alphabetical order.

Austria

Total bicycle sales value dropped 14.7% in 2023 to A$1.9 billion. For the first time, more than half of the units sold were electric.

France

The market by volume dropped by 14% to 2.23 million units. Within this, e-bikes dropped by 9% and analogue bikes by 16%.

Germany

Germany has the largest bicycle market in Europe both by value and volume. For many years the total market has been around four million units, but whereas a decade ago that was almost all analogue bikes, now it’s slightly more e-bikes (approx. 2.1 million) than analogue bikes, so the total market value has grown substantially over the decade, but the market was down 4% by value in 2023 compared to 2022.

Italy

Italy saw one of the biggest falls in 2023 with sales volume down 23% and sales value down 18% to $4.19 billion.

Netherlands

Bicycle sales dropped by 3.7% in value to A$2.35 billion in 2023. In 2023 consumers paid on average A$4,144 for an e-bike.

Spain

The overall market declined 7.2% by volume, with analogue bike sales down 9.2%, but e-bike sales were up by 2.28%

Switzerland

By volume the market dropped by 18.7% in 2023. E-bikes fell by a greater percentage (21%) than analogue bikes (16%)

UK

The market fell 6% in value in 2023 (unfortunately we don’t have the dollar value available).

Only 9% by volume of bicycles sold in the UK in 2023 were e-bikes compared to a 27% average across Europe and 50% or more for the most mature markets including Germany, Netherlands, Belgium and Austria.