How Many More IBDs will Bike Brands Acquire?

San Francisco, California, USA

Are we beginning to see a wider pattern of major bicycle companies looking to ‘vertically integrate’ by buying out some of their dealers or starting new stores from scratch?

Already for several years, Trek has been progressively buying dealers and in some cases starting new stores. This is USA head office initiated policy, but directly relevant to Australia. They had already started from scratch or acquired existing businesses totalling just over 20 Australian stores before the purchase of Perth’s largest independent bicycle dealer (IBD) business, The Bicycle Entrepreneur.

Now it appears that other majors are jumping onto this bandwagon.

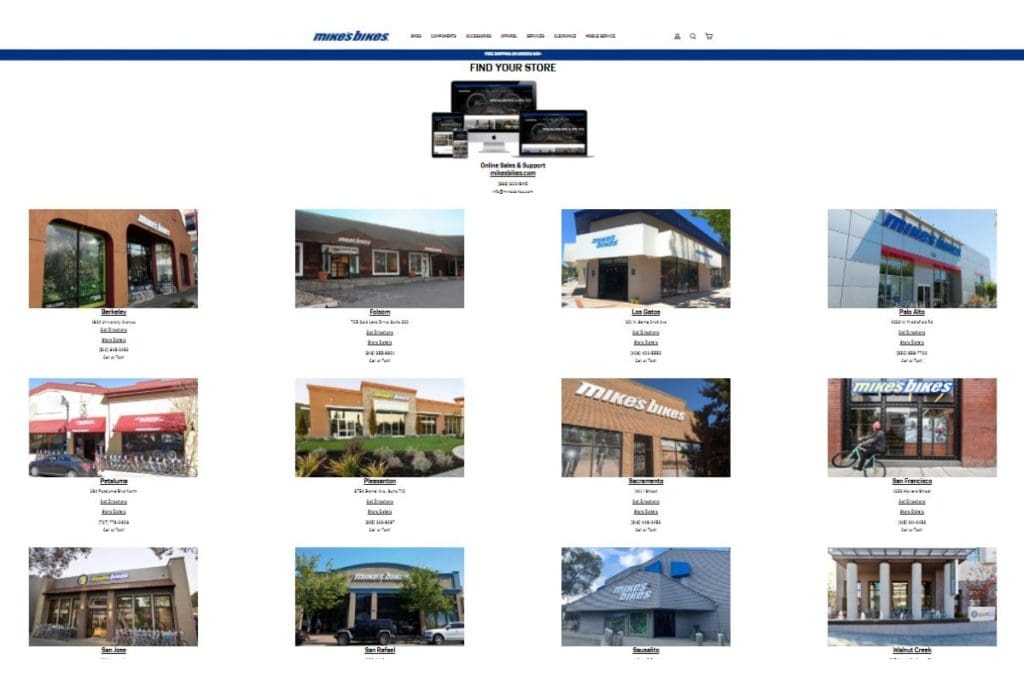

Recently Mike’s Bikes, a famous, long-established 12-store Northern California chain, has been purchased by Pon, the Dutch parent of Santa Cruz, Cervelo, Gazelle, Focus, Urban Arrow, and other bike, mobility, and auto brands. Pon also acquired Public Bikes, a city bike brand that Mike’s bought in 2017.

In announcing the acquisition of this iconic retail business, Pon said in a statement, “The acquisition of Mike’s Bikes aligns with Pon’s strategy to expand its retail operations in North America by acquiring premier specialty retail brands in top markets.”

That sounds like a strong signal that more retail acquisitions will follow.

Meanwhile Specialized has also been buying retailers in the USA. Bicycle Retailer and Industry News (BRAIN) recently reported that after 44 years in business, Bob and Kris McLain have sold Michigan based McLain Cycle & Fitness to Specialized Bicycle Components. Specialized has not confirmed the purchase and has declined to comment on this or other recent retail acquisitions. But industry sources told BRAIN the company has purchased, or is close to purchasing, several other stores and multi-store businesses in several states.

Further south in the major cycling city of Austin, Texas a turf war between the two USA market leaders is underway.

After Trek bought Austin’s leading retailer, the five store Bicycle Sports Shop which had previously been a big Specialized dealer, Specialized has just opened a store that is initially doing virtual consultations and home delivery, but once again, according to BRAIN’s sources will soon become a full retail operation.

What does all of this activity mean for IBD’s in Australia?

It’s too soon to say if Pon and Specialized will expand their retail acquisition strategy from the USA into Australia, but if they do, then we could see multiple brands competing to buy IBD’s. No doubt the pattern will continue of looking for multi-store businesses or long-established single site stores.

If that happens, retail owners who are looking to retire or to exit their businesses for any other reason could suddenly find that they have more potential buyers – and more money – on offer to them.

Meanwhile, those who choose to continue might find that their competitor down the road is no longer owned by another local family, but by a multi-billion dollar global corporation, who might also be one of their current suppliers of bicycles or P&A.

Some of this article was first published in Bicycle Retailer & Industry News (USA).

Join the Conversation

What do you think will happen to IBD ownership in Australia?