Latest Import Data Reflects Covid Bike Boom Import Surge

As we all know, dealers and wholesalers have been short of bikes since not long after the pandemic broke out. But the latest data is strongly suggesting that this shortage is not due to a reduction of supply.

In fact, imports have surged to record levels. It’s just that even these record imports have not yet been enough to meet the even bigger surge in demand.

We can now share Australian bicycle import data for the months of September to December 2020 and confirm that the covid bike boom is finally showing through in the data.

Numbers always fluctuate on a monthly basis, so we needed this data to start to see longer term trends.

In September 2020 151,737 bikes were imported. This was up 8% on 2019 and the highest September since 2015.

In October 2020 197,559 bikes were imported. This was 2% down on 2019, but that was by far the biggest month for 2019.

In November 2020 247,573 bikes were imported. This was up 60% on 2019. Looking as far back as we have records and to the best of our knowledge, this was the most bikes ever imported in a single month in Australia’s history.

In December 2020 218,248 bikes were imported. This was up a massive 135% on December 2019 and is the biggest December on record.

Looking at the longer term trend, for the first two financial quarters to date of the current financial year a total of 1,074,147 bicycles were imported.

That’s less than 100,000 short of the 12 month total for each of the two previous full financial years (1,170,987 and 1,132,225 respectively). So almost certainly those marks will be broken once we have January 2021 figures, after just seven months of the current financial year.

The all-time record was 2014/15 when 1,419,825 bikes were imported. That record will almost certainly be broken in the current financial year.

However, it would be too simplistic to project that the first half of this financial year will be repeated and we’ll be importing over two million bicycles. Traditionally the months of September, October, November are the peak importing season.

Normally imports fall right away from March onwards in particular, as we head into winter.

But even if we exactly repeated the second half of 2014/15, we would be importing 455,705 bicycles in the second half. If we added this to the first six months of this financial year, we would end up with a record breaking financial year total of 1,529,852 bicycles.

Our prediction is that, if international manufacturers can supply on time the stock that our importers have ordered, which is a very big and uncertain ‘if’, then the actual total at the end of the current financial year will be even higher than that record projection.

The import data also shows the split between adults and kids bikes. So far this financial year that has been 68% adult bikes vs 32% kids bikes. This represents a slight increase in adult bikes compared to the more usual split.

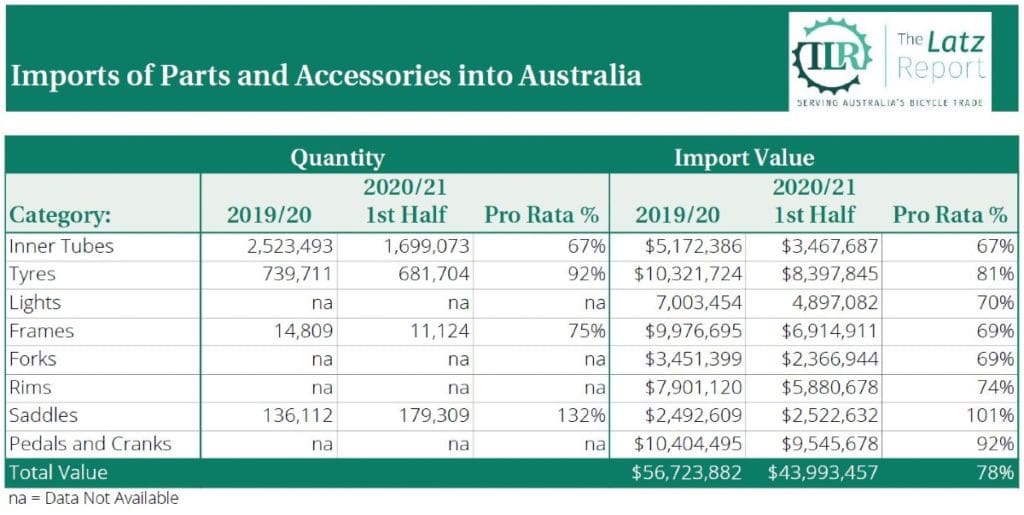

We now also have access to import data for Inner Tubes, Tyres, Lights, Frames, Forks, Rims, Saddles and Pedals & Cranks.

These are summarised in the table below.

As you can see, pro-rata, the first six months of 2020/21 financial year is up in every category on a pro rata basis compared to the full 2019/20 financial year. However it wouldn’t be wise to make too detailed assumptions because the usual import timing for each product category would vary at least slightly and in most cases, more would usually be imported in the first half of each financial year than the second.

But looking at tyres and saddles in particular imports are strongly up in both volume and value. The fact that the tyre volume increase, 92%, is significantly higher than the tyre value increase 81%, means that the average unit value was much lower. This may partially reflect the sudden demand experienced for ‘old style’ 26 inch MTB tyres and other basic, lower priced tyres for the thousands of bikes dragged out from the back of sheds and taken to bike shops for repairs to get them rideable again.

Bicycle Industries Australia kindly provides us with the bicycle import figures, which are collected by Australian Customs.

Join the Conversation: What do you think the total bicycle imports figure will be for the full 2020/21 financial year? If you’re closest estimate, you will win a spectacular prize (that we still have six months to source…)

I predict 1,529,852. 😁

While demand is in decline currently, I don’t see that it’s at a point where importers would try to modify their orders. If anything I’d predict they will have over-ordered and the final number will wind up greater..

All the data I’m seeing and discussions I’m having suggest that suppliers are manufacturing at record levels. They have certainly faced challenges at every step of the process, from shortages of certain raw materials through to delays in supply of component parts, then having to modify their work practices and in some cases staff shortages and finally, major shipping delays, shortages of shipping containers etc.

But they’re highly incentivised by being able to immediately sell everything they make, usually on back order.

So are suppliers manufacturing at record levels too or is this still suppressed due to COVID?