World News Briefs: Giant to Sell via ‘Big Box’ Retailer in the USA

Giant Opens ‘Big Box’ Retail Accounts in the USA

Giant Group announced in early February that it will be selling via “approximately” 25 selected stores within the huge Dicks Sporting Goods (DSG) chain in the USA.

Those stores are branded House of Sport, Public Lands and MooseJaw. According to Wikipedia, Dick’s is the largest sporting goods retail company in the United States, with approximately 854 stores, and 50,100 staff as of 2020. The company reported total sales of US$9.584 billion (A$14.6 billion) in 2020. They do not have any stores in Australia.

In an email to Giant dealers in the USA, Giant said that Cannondale, GT and Intense have already been selling via DSG for some time. They also listed a range of non-bike shops that Trek, Specialized and Pon sell through in the USA.

Giant said that they were not moving away from specialty retail (bike shops).

Their Q&A document said, “We value all our retailers and remain committed to our business model of supporting specialty retail. Your health is our health, and we will continue to prioritize the success of our retailers.”

Initially DSG will stock a full range of mountain bikes including entry-priced e-MTB, plus kids’ bikes. Giant also expects their bikes to be available through the respective DSG online stores.

We wrote to Giant Australia to ask if there are any plans for Giant bikes to be available via similar “Big Box” retailers in Australia. Martin Clucas, National Sales Manager, replied saying, “Currently, Giant Australia remains dedicated to an IBD sales channel model, supported by our E-commerce platform, which returns profit margin to our retail partners.”

Some of this article was first published here in Bicycle Retailer and Industry News.

Shimano’s Bicycle Division Sales Drop Almost 30% Year-on-Year

On Tuesday 13th February Shimano published their full financial year results for 2023. The Japanese company operates on financial years that run from 1st January to 31st December.

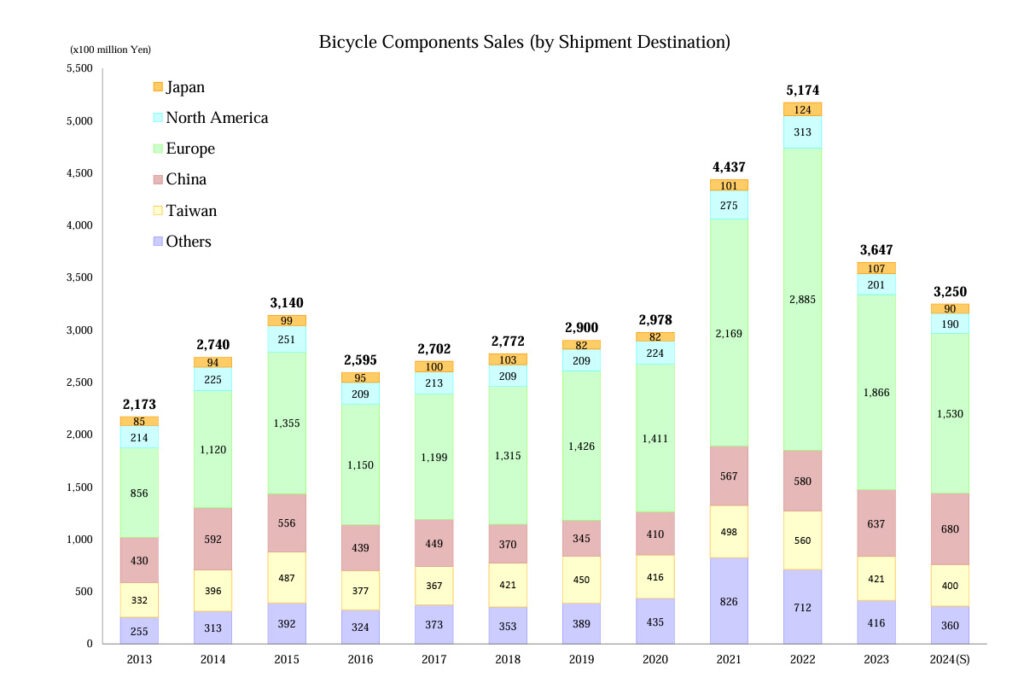

Total sales in its bicycle division were 364 billion yen (A$3.74 billion). This was 29.5% down from Shimano’s all time record bicycle divisions sales of 517 billion yen (A$5.32 billion) in 2022.

However, as you can see from the chart that accompanies this article, the result is still significantly higher than pre-covid years. Shimano is projecting a further 12% fall in sales for 2024.

“Although the booming popularity of bicycles cooled down, interest in bicycles continued to be high as a long-term trend,” Shimano said.

Shimano’s net profit fell more sharply, down 52.3% from 2022 to 61 billion yen (A$628 million) for 2023. That still represents a healthy profit as a percentage of sales of 16.7%.

It would be interesting to know how much, if any, of Shimano’s 2023 fall was due to a loss of market share and how much is due to an overall decline in the market. But because most of Shimano’s competitors, including the largest one, SRAM, are privately owned, they are not required to publish financial statements. Therefore, there is no data available to answer these questions.

The attached chart shows that Europe is by far Shimano’s largest market, having been steadily growing as a proportion of their global sales to be just over half in the most recent two years. The true figure is probably slightly higher, because most of the sales to Taiwan would be to bicycle factories for bikes that are then exported, many to Europe.

It also puts into perspective the true popularity of cycling in Europe compared to North America, which has a comparably sized economy, slightly smaller population, but a market for Shimano that’s about eight times smaller, once again, subject to adjustments related to bike imports from other countries.

Meanwhile Australia and New Zealand would probably only account for a small percentage of ‘Others’ when you consider that this category also includes the entire continents of South America, Africa and most of Asia.

Shimano reported that its full-year loss from its 11-speed crank replacement program was 17,625 million yen (A$18.2 million).

Shimano’s balance sheet showed assets of 871 billion yen (A$8.9 billion) and liabilities of only 69 billion yen (A$711 million) to equal net assets of 802 billion yen. (A$8.2 billion). In other words, it’s in an extremely strong position to weather any downturn.

BMC Applies for Swiss Government Assistance to Continue Trading

Swiss bicycle manufacturing BMC has applied to the canton of Solothurn for a “short-time working” according to local news outlet Grenchner Tagblatt as the difficult economic situation in the cycling retailer sector and the industry continues to hurt brands of all sizes.

Short-time working effectively allows a company to reduce the working hours of full-time employees during downturns, in a measure intended to reduce the potential for layoffs.

BMC’s most conspicuous cost-cutting measure in recent months has been an exit from the WorldTour peloton in 2024. In the past the brand sponsored multiple WorldTour teams.

BMC is however sponsoring the Swiss Tudor Pro Cycling team, which has secured a number of wildcard places at the top-flight races this year, including for the Giro d’Italia.

Short-time working can be introduced by a company following approval by the local canton, or municipal government. Following successful approval the local government pays the company in question the value of 80% of the staff wage bill, preventing the affected company from having to make layoffs.

BMC is best known to many Australians as the bike sponsor of Cadel Evans’ team when he won the Tour de France. It started as a niche company based in the USA, but was turbocharged when Andy Rihs, the billionaire owner of the global hearing aid company Phonak bought BMC in the year 2000.

Andy was a cycling enthusiast who poured huge amounts of money into both the pro race teams that he sponsored, and BMC particularly in carbon frame R&D. Unfortunately Andy died in 2018 and most likely with him, BMC’s access to “supportive” funding.

Some of this article was first published in Cyclingnews.com