Australian Bicycle Imports Remain at Record Lows

Canberra, ACT

Every Australian bicycle retailer and wholesaler knows from first-hand experience that since the end of Covid lockdowns, our market has been overstocked, resulting in widespread discounting which causes unwanted erosion of margins and profits.

While this situation is not universal across all bicycle categories, particularly in the high end, in the volume market of low to mid-priced adult bikes and kids’ bikes, there has been significant excess of stock at both wholesale and retail level.

Ultimately there are only two things that will clear this problem, either singly or in tandem – reduced supply, of which almost all is imported, or increased demand.

Unfortunately, the Australian bicycle industry does not collect good industry-wide sales data, so we can’t accurately report upon the latest levels of consumer demand, but we can accurately track imports.

We reported here back in May that the number of bicycles imported into Australia during January and February 2023 were at all-time lows.

“Total imports for the first five months of 2023 are … sitting more than 50,000 units below the previous record low in 2010.”

We recently received data from March to May 2023 and this trend is continuing.

For the three months combined, a total of 113,463 bicycles were imported. That comprised 35,373 in March, 43,591 in April and 34,499 in May. Going all the way back to 2009, there’s not a previous year that is anywhere near that low for the same three month period. In fact, the closest was 150,584, back in 2010, which was still 33% higher than this year’s three-month total.

When you add January and February and compare the first five months of this calendar year with the previous two ‘Covid years’, the contrast is even more stark.

Total imports for the first five months of 2023 are also by far the lowest for that period since at least 2009, sitting more than 50,000 units below the previous record low in 2010.

For the five months from 1st January to 31st May 2023, we have imported 200,591 bicycles. Last year that figure was 542,265 and in 2021 it was 518,344, so the rate of imports has been running at more than 60% down compared to each of the previous two years.

Even back in 2020, where you will recall that global supply ‘dried up’ from about April due to the unprecedented global demand and the Covid bike shortages began, we still imported 36% more bikes for that five-month period – 273,460 to be exact.

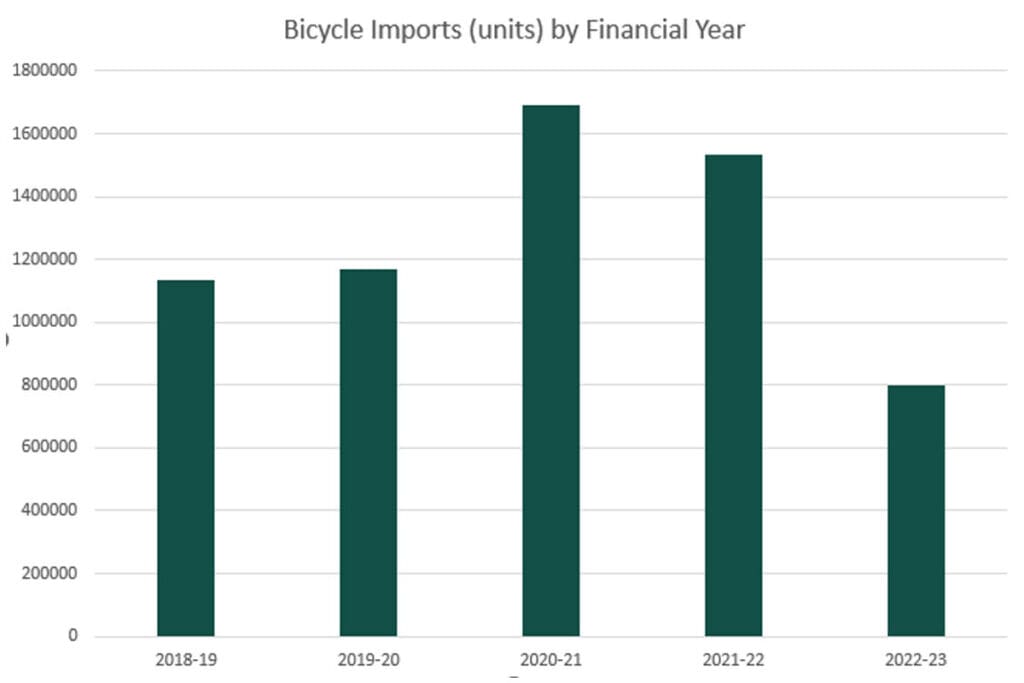

Looking at the full financial year, with only one month yet to be reported upon, it’s likely that the 2022/23 financial year total will finish very close to 800,000 units. In 2020/21, the first full financial year of Covid, that total was 1,690,637 and in 2021/22 it was 1,534,544. So imports for the most recent financial year will be almost exactly half of the Covid average.

Within the latest 2023 import data, children’s bike imports have recovered very slightly relative to adult bikes for the months of April and May. A total of 63,929 kids’ bikes have been imported during the first five months of this calendar year, compared to 136,662 adult bikes.

The relative mix of adult to kids’ bikes is running at 68% adult, 32% kids. This is within the relatively narrow band of 66% to 72% that has been the proportion of adult bikes, within total bikes imports, for every year over the past decade.

Average import values remain higher than their traditional average but with large variations on a month-to-month basis. Averaging the most recent five months of data, the import value is $589 per bike (at the declared customs import valuation, which is roughly half of the recommended retail price). That compares to $353 in 2022 and $238 in 2021.

Explaining the reason for this increase leads me to a confession and whole exciting new world of data… at least if you’re someone who finds data exciting!

My Confession Regarding E-bike Import Data

Until now, I was not aware that there was a separate tariff code that includes e-bikes.

Code number 8711.60.00 has the following definition: “Motorcycles (including mopeds), bicycles and other cycles fitted with electric motor for propulsion, with or without side-cars.”

Meanwhile, regular bicycles are imported under code 8712.00.00: “Bicycles and other cycles (including delivery tricycles), not motorised.”

There is data for code 8711.60.00 going back at least six years, so I apologise for my ignorance about this until now.

Clearly it would be far better for our industry if the Australian Government split e-bikes into their own category. But the volume of bikes being imported under that code is so large and growing so fast, that I’m devoting a separate article to it, that I’ll link to here.

Now knowing about this separate code has two implications regarding my commentary about bicycle import data.

The first implication is in relation to the increase in unit value of bicycles that we’ve seen, particularly since November 2022. In previous articles I’ve speculated about four possible reasons for this. I think that three of these are still valid:

- That the Australian dollar has fallen over the past year, particularly in relation to the US dollar.

- That because of the relative overstock of kids’ bikes and lower-end adult bikes, the product mix of imports has temporarily shifted towards a higher proportion of more expensive bikes.

- That global manufacturers have been raising prices, particularly through Covid (although current tough sales conditions might be starting to reverse this trend.)

But the fourth reason I gave, increased e-bike imports, is probably not valid if most e-bike importers are correctly using the ‘e-motorbike, e-moped and e-bicycle’ code 8711.60.00 for their imports.

The second, and larger, implication is in relation to the drop in bicycle import units we’ve seen, particularly during the past seven months. As you will see from the second article linked to above, the relative strength of imports under the ‘e-motorbike, e-moped and e-bicycle’ code will offset this drop to a degree because e-bike imports appear to be only dropping slightly this year, after six years of rapid growth.

Thanks to Bicycle Industries Australia (BIA) that compiles the monthly import statistics from data supplied by Australian Border Force.