Industry Guru Gives His Assessment of Future Product Supply and Demand

Many members in the bicycle industry have either met or know of the American bike industry veteran Bob Margevicius. As well as being long time Executive Vice President of Specialized, he’s also renowned as an enthusiastic cyclist and supporter of the bike industry, former New Zealand resident and the Vice Chair of the BPSA (Bicycle Product Suppliers Association) in the USA.

Bob recently travelled to Taiwan to speak at the 2021 Smart Cycling Forum, which was part of the mainly online event held in place of the regular Taipei Cycle show that was cancelled due to covid-19.

As he readily admitted during his presentation, he was also in the country for meetings with component suppliers, no doubt hoping to maximise Specialized’s leverage in the ongoing scramble by bike brands to secure supply.

Of course, no-one has perfect knowledge or can predict the future with any certainty, but given his position in the industry and years of connections and experience at a global level, it’s worth hearing what he had to say.

You can see Bob’s full presentation towards the beginning of a 3-hour 20-minute video of the conference here.

But if you don’t have time to wade through, find and then watch the full presentation, here are some of his key points.

“In every crisis, there’s an opportunity,” he began, “And certainly the bike industry has experienced an amazing crisis and we’re looking at the opportunities that are available today.

“The bike industry for more than 25 years has been stable, particularly in the developed market.

“The pandemic resulted in a surge in the bicycle market of 32% in a one year period.

“We have worked our lifetime for this moment, when people are recognising, realising and respecting what cycling brings and the joys of cycling.”

Bob then presented a detailed set of slides and data. Although it was not immediately clear, it seems that most of his data related to combined USA and European sales and demand, not global figures.

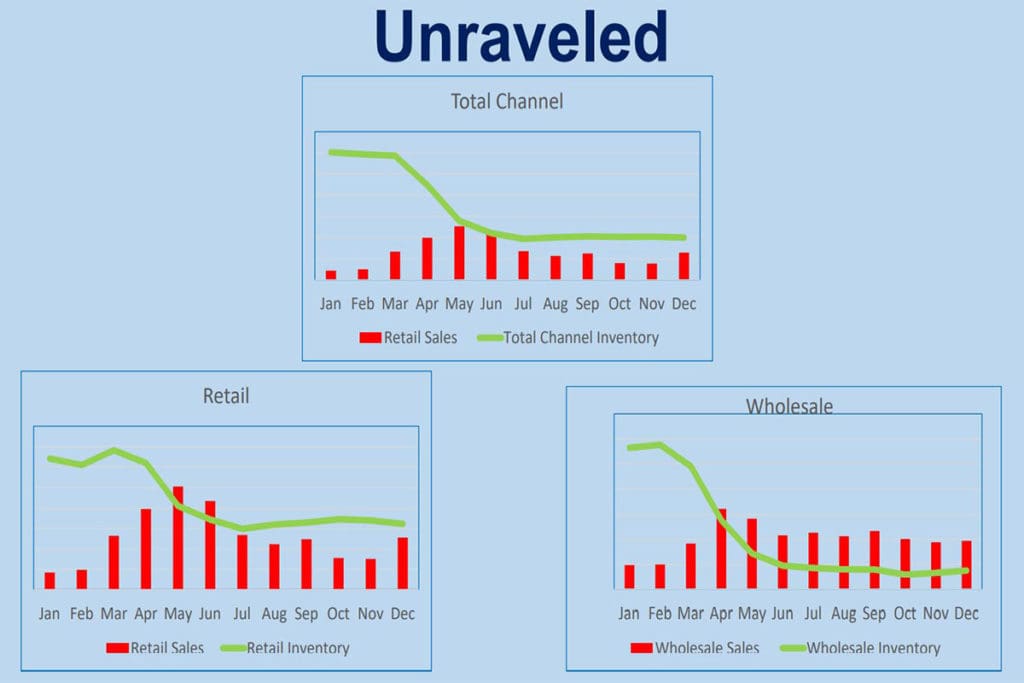

“We started with about eight months’ worth of inventory on hand in January (2020),” he explained.

Then as pandemic bicycle demand surged, inventory levels dropped to historic levels.

“Suppliers and manufacturers were not and are not prepared for this surge,” Bob claimed. “But fortunately there was inventory in the channel. The sales in those months depleted inventory in the (wholesale and retail) channels by 50%. Demand continues to pace at 30% or greater than previous years.”

The next section of his presentation was directly aimed at the Taiwanese manufacturers, with over 100 representatives in the room and the larger audience watching online.

“Component suppliers and the assemblers today are struggling to supply even a 10% gain,” he claimed. “That’s a real challenge for all of us in the industry. Everything that we’re getting in is immediately selling through.

“We’re placing orders 12 to 24 months in advance, when historically we were placing orders with 60 day lead times, 45 day lead times.

“The key point is that one bike has about 238 different components (broken down to the small parts level). So if one of them has a lead time of 300 days that means everything has a lead time of 300 days.

He then asked, “Can we handle this growth?

“Over the past 10 months, inventories globally at both wholesale and retail channels (combined) have been drained to an unprecedented 1.75 months on hand to satisfy the current demand surge and demand continues to pace at 20% to 30% over the previous years’ sales, far outstripping supply.

“We’re seeing factory efficiency gains here in Taiwan of 10% to 15%.

“Current factory orders are two to three times previous years. There’s no sign of relief for component makers, many of which are very reluctant to invest in additional capacity.

“We started 2020 with 16 million bikes on hand (total European and American inventories at wholesale and retail) and we received about 32 million, comparable to previous years sales, but (2020) sales surged to 42 million, an increase of 32%. So what happened? Ending inventory, at the end of 2020 decreased by 62%.” (from 16 million to 6 million)

“I’m forecasting a lower retail sales level (for 2021 compared to 2020). But we’re starting with six million bikes and demand is going to be around 38 million and I’m forecasting that we’re going to get 10% more bikes, maybe. (ie manufacture will increase to 35 million) So we’re still in a deficit spot. Inventory will drop from six million to three million.

“So we’ll start out 2022 with only 3.2 million bikes in inventory and even with a 10% increase in actual production and receipts, so a 50% increase over the next five years, by 2025 we will have nine million bikes in stock, so we’re still far behind. (compared to the 16 million bikes in stock in 2019). We won’t be able to catch up.”

Not All Orders Will be Fulfilled In 2021

Bob continued, “We’re seeing a demand in 2021 of 38 million bikes, but we’re seeing orders of 52 million bikes. (to rebuild stocks). 62% growth is what everybody wants, but the industry can only deliver 10%, so you can see the mismatch.

“What can we learn? Without inventory in the channel, this industry would have been crushed.

“In this there were some winners and losers – or at least people who didn’t win as well.

From the retailers’ side, the omni channel retailer that had multiple brands… he did good.

From the wholesaler side, the big, large, economies of scale businesses did good. They had good leverage over their suppliers.

Longer Term Outlook

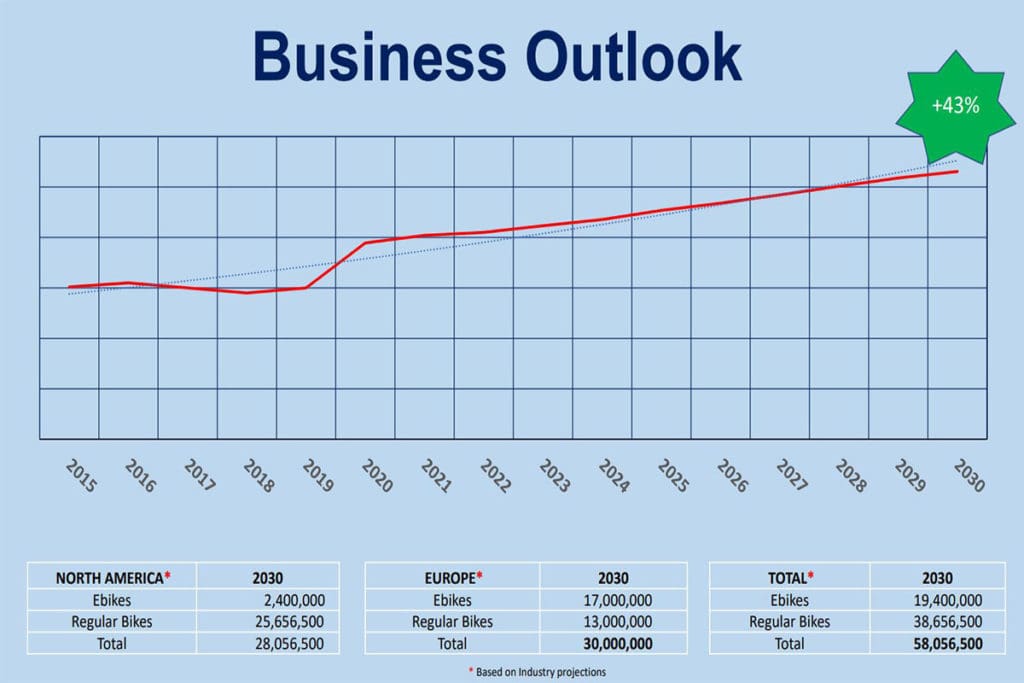

“The outlook for the industry thru 2030 is an increase of 43%,” Bob continued. “We couldn’t meet these numbers without increases in capacity and the ability to deliver.”

In summary, Mr Margevicius listed seven reasons that bike demand would continue to grow throughout the decade of the 2020’s. The notes below are not his full comments on each of the seven reasons, but give you the gist of his arguments.

- “We’re seeing changing behaviour and that’s not going to snap back. People are going to stay at home, work from home and their going to continue to use bikes.”

- “Governments around the world are realising that bicycles are an essential part of living. We’re suddenly getting the respect and recognition that we earned in this business and we should cherish that.”

- “Government incentive programs – there are amazing incentive programs. Even in the US we’re looking at an incentive program where there’s potentially US$1,500 for people buying ebikes. There are these kinds of schemes throughout the world. Governments are behind it. People want bikes and people are buying bikes.”

- “Infrastructure. You’re starting to see a lot of infrastructure being built for bikes. Infrastructure drives people riding.”

- “We’re starting to see a lot of investments in safety. Whether it’s B2V, bicycle to vehicle communications… the product’s getting safer.”

- “Social rewards. Social benefits of people engaging and being together. That’s not going away.”

- “People are using bikes for transportation. There’s a growing segment of bikes being used for transportation around the world and that’s here to stay.”

Mr Margevicius concluded with a strong call to action for the Taiwanese manufacturers. “There’s a gold mine in the bike business, there really is,” he exhorted. “We have to invest in it! We need to retain these pandemic riders. Let’s identify ways we can keep them. We need to convert indoor riders to outdoor riders.

“Cycling is becoming more socially acceptable, safe, personal, convenient, a reliable source of personal mobility. The future is now!

“There’s billions of dollars to be made and profits to those who believe and invest in a healthier and stronger business. Invest – you’re either at the table or you’re on the menu guys! If you’re on the menu, there are other countries, other companies that will certainly have you for lunch.”