Taipei Cycle’s Smiling Face Hides a Tough Market

Taipei, Taiwan

Sometimes people have to put on a brave face. If you walked through the bright halls of this year’s Taipei Cycle and didn’t stop to speak to anyone, you’d probably think that the Taiwanese and global bike industries were booming.

But in reality, the opposite is true. I heard multiple stories about factories working short weeks, so that they can retain their skilled workforce, but also cut costs and production to match the current weak demand they’re receiving from overseas buyers.

Although this year’s Taipei Cycle was larger than last year in terms of exhibitors, visitor numbers were down, in particular, the much coveted international buyers from North America and Europe. In total there were 23,700 visitors this year including 3,623 international visitors, 13,590 domestic trade visitors and approximately 6,487 public who mainly attend on the final day, which is a Saturday.

This year 93 Australians and 14 New Zealanders attended, which is an impressive total, given the tough market conditions, but well down on pre covid attendance.

By comparison, the top five countries for international visitors were Japan (520), Mainland China (362), USA (292), South Korea (247) and Singapore (189).

They came to see 950 exhibitors filling a display area equivalent to 3,500 standard 3×3 booth spaces. In addition to Taiwan, exhibitors came from other 31 countries.

Taiwan is a critical bicycle industry manufacturer for Australia, which in turn is a very important market for Taiwan. In fact, data published by Statista for 2022 bicycle exports from Taiwan remarkably shows Australia as their third largest country market, trailing the USA and the Netherlands, but ahead of the UK, Canada, China, South Korea, Belgium, Japan, Germany and France, in that order.

New Zealand also punched above its weight population-wise, being in 14th place, just behind Italy, but ahead of Spain.

Official data released by the Taiwanese Government and compiled by the Taiwan Bicycle Association for 2023 tells an overall grim picture.

In total, the Taiwanese bicycle industry export value was down by 30.43% compared to 2022 to US $4.302 billion (A$6.6 billion). This includes both complete bicycles and P&A.

1.324 million complete analogue bicycles were exported with a total value of US$1.384 billion (A$2.13 billion) which was a 14.46% decrease from 2022. In some good news, the average unit price increased by 26.16% to US$1,045 (A$1,583).

E-bike exports are counted separately and in addition to this total. But even the e-bike market declined by 33.74% in units to 687,000 units. The total value declined 21.91% to US$1.213 billion (A$1.866 billion). The value declined less because the unit value rose by 17.85% to US$1,767 (A$2,718).

The value of P&A exports was down more than any other segment, by 43%, to a total of US$1.705 billion (A$2.62 billion)

Australia was Taiwan’s seventh largest market for analogue bicycle exports, accounting for 52,000 units in 2023. Ahead of Australia, in order from the top were the USA, Netherlands, China, Germany, UK and Japan. By value, Australia ranks 4th in this category at US$68.3 million (A$105 million)

Australia is an even more important market for e-bikes, importing 18,000 of these higher value bikes. In terms of volume, it ranked fourth, behind the Netherlands, USA and Germany in that order.

Australia ranked sixth highest in terms of e-bike value at US$39.9 million (A$61.4 million).

I can remember that when I first attended Taipei Cycle in the 1990’s, their export volumes were closer to 10 million bicycles (no e-bikes in those days) with a unit value of around US$100 (A$153).

So, in very round figures, the volumes have dropped about fivefold to today’s total of about two million (combined analogue and e-bike) units, but unit values have increased about 10 fold for analogue bikes and 17 fold for e-bikes. Therefore overall, even in this toughest of seasons, the industry is still doing about triple the total value of exports compared to the mid 1990’s.

Both exhibitors and visitors that I spoke to were hoping that the imminent northern hemisphere summer season would see their fortunes revive. It has certainly been a tough hangover after the two year covid party.

Six Trends

Here were six trends that I learned from attending this year’s Taipei Cycle:

Trend One:

We’re doing better than most!

As we all know, the Australian bike market has been tough since covid ended but from conversations with exhibitors and visitors it sounds like most other countries are doing worse than us.

Few people were game to predict when the market would turn, but some were saying that one more northern hemisphere summer should clear the backlog and see the Taiwanese manufacturers enjoying stronger orders.

Trend Two:

It was a quiet year for new product releases.

I’m not a product expert and I’m just one set of eyes at a huge expo, so I’m sure to have overlooked some significant new products, but there were relatively few major new product announcements or launches.

Logic suggests this was both a strategy for cash-strapped brands and manufacturers to save money on R&D and new tooling, but also because overstocks need to be sold through first, so immediate demand for new products launched now is likely to be weak.

Some attendees predicted that there would be more new products launched at Eurobike in July.

Trend Three:

There was a huge emphasis from Taiwanese manufacturers on ESG (environmental, social, governance) especially the “E” part.

This was evident in signage and displays all over the expo. An environmental seminar held during the show was packed, with every seat taken and more people standing along the back wall.

At least some part of the impetus behind this is fear of new European regulations that may restrict the importation of products that do not comply with tougher standards. These might relate to everything from packaging to materials sourcing, using renewable energy in factories and recycling of waste materials.

Trend Four:

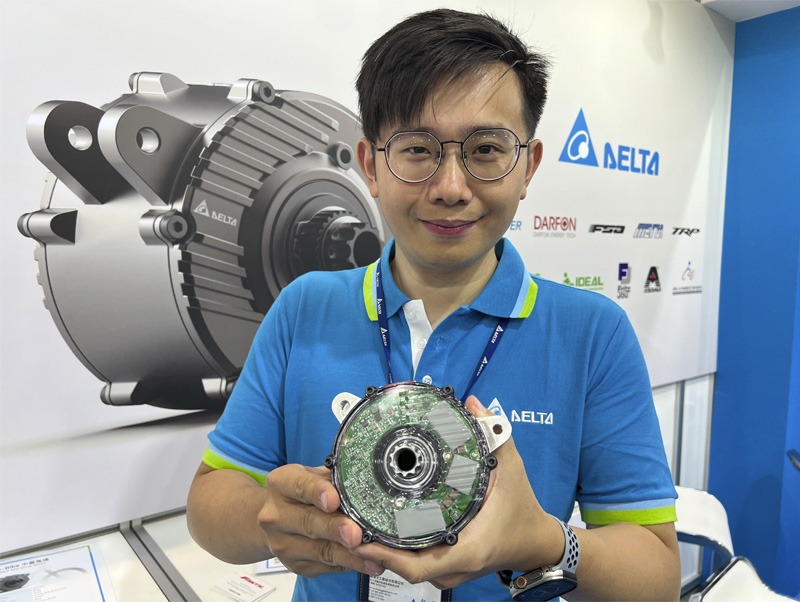

There were so many new players in e-bike drive systems, battery systems and related markets such as e-cargo. Perhaps many of these companies are not brand new, but certainly new since I last attended.

Looking at the products from many of the smaller suppliers, I couldn’t help but wonder how many were compliant with international standards, particularly when it relates to critical charging systems and battery design to prevent thermal runaway and fire.

Newer, smaller entrants might find it tough in a market where dealers are finding it harder to get affordable insurance and the safest option is to stick to known major brands.

Trend Five:

I saw some interesting new electronic display and control systems, new motors etc. Some of the companies behind these are new entrants to the bicycle industry, who have huge manufacturing bases and expertise after years in other industries such as automotive.

These new products won’t be on bikes in Australia tomorrow, but it’s likely that we’ll see a steady increase in sophistication and features on more and more bicycles.

Trend Six:

There seems to be a gradual decrease in the emphasis upon model years for bicycles and components. This might partly be due to the fact that e-bike drive systems are not model year designated. Some might argue that having new model years helps drive consumer demand, but the large downside is that it creates artificial obsolescence of perfectly good stock, leading to discounting pressure.

Here’s a look at some products and activities that caught my eye at Taipei Cycle this year: