Exclusive Interview: 99 Bikes’ Departing Founder Reflects upon Lessons, Wins and Massive Future Expansion

Brisbane, Queensland

When Matt Turner founded 99 Bikes in 2007, he had no prior bike industry experience, apart from being a keen triathlete being a dissatisfied customer of his local bike stores.

Little did those stores who gave him bad service at the time realise, they’d be sowing the seed for what is already by far Australia’s largest bicycle company, with much greater growth planned for the future.

Now, over 14 years on, the Pedal Group, which consists of wholesaler Advance Traders in addition to the 99 Bikes retail chain, recently revealed to their dealers that Matt would be moving on from his role as Managing Director to start in a completely different industry.

The Latz Report took this opportunity to ask Matt to reflect upon the earliest days of the business, lessons learned, secrets to success and plans for the future.

The Latz Report: I think that the first time I met you was at Milton, which was your very first store, correct?

Matt Turner: I think you’re correct on both counts. It was definitely our first store. Whether that was when we had one store or we had the second one open at the time, I’m not sure.

I spent a year just on that one shop. For the first four months while we were open, I would have been in the shop the whole time.

“We have a 2027 goal of having a turnover of $1 billion.”

Matt Turner

TLR: When did you first get the idea and what motivated you to start 99 Bikes?

MT: I did physiotherapy through uni and I was working as a physio. After about the two-year mark, I just started feeling a bit bored. I didn’t think I was going to really enjoy being a physio because it was much more repetitive than I thought. I just didn’t think that suited me very well.

I was heavily into bike riding – probably more triathlon. You could just see the popularity growing. Then, I had a few experiences in local bike shops that I went to that I wasn’t that happy with.

Two ones I remember: I wanted to order a mountain bike tyre. They wrote it in a book and they said, ‘Yes, we’ll order it in for you, come back in a week.’ I came back in a week and they were like, ‘Oh, yes… not sure if we ordered that, what was it again?’

Another time I got my bike serviced and test rode it. The gears weren’t working! That was the one thing I went in there for, wanting the gears to work better.

They were the motivators.

I thought mom and dad would be happy to fund the start up. I spoke to them and they said, ‘Yes, we’ll be happy to fund that.’ Sort of no questions asked, they transferred $500,000 and said, ‘Have a go at opening a bike shop.’

We did 50/50 ownership – they put in all the money and I put in the sweat equity. It was just, ‘You take 50%, but you do all the work!’

TLR: Can you remember what date it was when you made the decision, ‘Yes, we’re going to do this!’

MT: It would have been October 2006. That happens to be when I did my personal best for the Noosa Triathlon.

We incorporated the company in February 2007. Then we opened the doors in May 2007.

The Flight Centre got involved about a year after we opened the first shop. (Matt’s father Graham Turner is co-founder and Managing Director of Flight Centre Travel Group.)

That was when we got into wholesale and we needed their support to do that. I suppose a little bit on the funding side, but also on the reputation side, because it was the opportunity to distribute Merida.

We purchased Advance Traders as part of it. Knowing Merida a bit more now, I think they went with us mostly because they just really loved to back the incumbents. The fact that we were taking over the current staff… they’re just off the charts when it comes to loyalty.

Looking back, maybe we didn’t need Flight Centre as much as I thought we did, but we thought that would be a better story to pitch to them, that it was Flight Centre and the Turner family together.

“I think we can be a global retail brand.”

Matt Turner

TLR: You were only about a year or so into 99 Bikes when you acquired Advance Traders. Was that something you actively pursued or were the previous owners looking for an exit?

MT: Yes, they actually announced they were closing. It wasn’t something we were looking at. I think I definitely had enough on my hands already!

But what I was starting to realize is how important wholesaling was to us. We’d been knocked back by a few wholesalers, and you could sense that they had a fair bit of power in the relationship.

It was only on my radar from that perspective. Then when Advance Traders said they were shutting down we thought, ‘This is a pretty good brand, and they’re just shutting down.’ Then, we just opportunistically reached out to them.

We paid $150,000 goodwill, which they wouldn’t have got if they just shut it down.

TLR: That’s a staggeringly small amount of money. Obviously, you’ve since grown the business, but Advance Traders was a substantial business even then.

MT: Yes, I think we all also bought all their stock. That probably had a fair bit of value to them at the time as well.

TLR: Can you paint a broad picture where the Pedal Group is up to now?

MT: We have 66 stores, which are either open or just about to open pre-Christmas. Of these, 59 are in Australia, plus seven in New Zealand. We have about 600 full-time equivalent staff in retail and around 60 staff in wholesale across Australia and New Zealand.

TLR: That’s quite phenomenal growth from a start-up in 2007. What have been the keys to your success?

MT: I think the first key was having the Flight Centre model that we could copy. I say that because it gave enough confidence to me and to the rest of the team that there was this successful model that we were copying. I think there happened to be just enough similarities that enough of it transferred. Where most of it transferred was around sales training and people management. That was very key at the start.

Flight Centre gave us not just a way of how to run a retail store with the people involved, but a way to run it at scale. They’d been through that learning. They gave us the two elements: how to run one store and how to run a group of stores.

I feel like another relatively specific key to success was employee ownership. We found a way to make people feel like it was their business. We’ve ended up doing real shares, real ownership, as a key factor. That has been a key to success, getting enough people on board for the long haul.

There’s a lot of other aspects around giving them autonomy to make their own decisions. The end result, some good quality people feeling like it’s their business, has been a big part of the success.

Learning how to manage stock has been a secret to success. That’s something that we didn’t copy from anyone, we just learned on the go. We hired a few people along the way who helped us, some key hires for sure. Some good people who stuck it out in the stock, product and the logistics side of it. That’s the part that we obviously didn’t learn off Flight Centre.

The fourth key is the property side of the business, which is a little bit similar to stock, but probably one I’ve been more involved in – a bit more hands-on in the property side.

We really did learn through trial and error on the property side. We were lucky enough to have a lot of goes at it. It’s an expensive thing to trial and error, I suppose! (laughs)

TLR: Are you referring to purchasing retail sites? Or are you also just referring to leasing the right locations?

MT: Mostly leasing has been our history. Leasing the right location for the right price and the right deal. Because once we got that ability under our belts, that then allowed us to purchase with some certainty as well.

Even now, we own maybe 13 or 14 of the 66 sites. Purchasing hasn’t really paid off yet. It’s more of a long-term view that hopefully will pay off in the long run.

TLR: When you’re leasing a new 99 Bikes store site, have you got a sweet spot of rent per square metre per year that you want to pay?

MT: Yes. It’s not easy to give you one number because they also vary a lot in areas.

I often bring it back to supply and demand because even within an area, there’s some catchments that just, if they’ve got a low supply of bulky goods retailing… it’s quite volatile. You could be paying half the amount of rent or double the amount of rent, and you could justify both of them. Our average is about 500 square metre sites (of floor space) for around about $200 a square metre.

TLR: That’s really cheap rent. Do you have to go for longer leases to get that?

MT: Yes, we do. We’re signing between five and 10 years. Sometimes it’s important to the landlord, sometimes not as much. Yes, we’ve probably been too precious about not paying (high) rent. But especially from the times that we were unprofitable, we got pretty worried about paying big rent. I think the fifth store we opened was Chermside (This was an imposing 850 square metre store in an extremely prominent, modern building on the main road in the northern suburbs of Brisbane.)

It was like, ‘Let’s go bigger and better!’ That was one of the trial and errors I was talking about. That was a mistake. Even on the rent reviews, of the escalation of rent was quite high. Then there were outgoings.

We ended up paying $300,000 a year. It was a good learning, where the rent was just going to sink that shop, even if we shot the lights out with sales.

We don’t have any stores like that anymore. I think our most expensive at the moment would be $220,000 a year. And we were paying $300,000 a year a long time ago. (Perhaps $400,000 in today’s money.) It was obviously too much.

TLR: I think your Earning to Give program deserves mention. I see that you’re up to just under $1.4 million total donations now and for the 2021 financial year alone you donated $451,000. You must be proud of that initiative.

MT: Yes, I’m proud of it, but, yes, the dollar figure might sound impressive, but in the sense that it’s 1% of everyone’s earnings, it’s actually quite a small amount. It’s enough to be meaningful without being a huge burden.

The absolute best part is that everyone decides. I can see it’s slowly having a good impact with getting a lot of people on the scale. It’s giving everyone a kickstart into charity or philanthropy. It’s very interesting seeing a high percentage of people just don’t have any idea or find it hard to even make a choice. Then there’s a percentage though that are very passionate about their cause. It’s great seeing them be passionate and give a little bit of a platform to then inspire the other people.

That sense of responsibility as well of, ‘Okay, I’ve got $1,000. I’ve got to decide where to donate it.’ I love that part of it that it reaches everyone in the business and gives everyone equal choice, but then equal responsibility, on where it should go.

TLR: People reading this interview might be wondering, ‘Why would you be stepping away from such a successful business when you’ve learned the hard way, and it’s really kicking goals now?’ Why are you doing that and what are you going to be doing next?

MT: Renewable energy is an area I’m really interested in and know a small amount about. I haven’t committed to anything, but I knew people are going to ask this question, so I needed a good answer!

I see the similarities of bikes. I’ve got the interest in it, but also popularity is just skyrocketing. I can see it being a pretty dynamic and high-growth area. I think there will be lots of good business opportunities there too.

Why am I stepping away from Pedal Group? There’s probably a lot of different little reasons. One thing I said to a few people is that was because there was this little doubt in my mind whether I wanted to keep going. I looked into it as a serious decision.

I’m comfortable that we had people internally that could take over my role.

I really don’t think the company’s going to suffer at all from me not being here. It was a tough decision, but it was between two good choices. I felt the most important part was me to pick something definite. That’s what I’ve done.

I’m very committed to making sure that I do step out of the company and leave it for other people to run. That’s going to be a balance, because I’ll still be on the board of directors. I’ll still be a major shareholder, but I suppose I see that as a challenge. How can I stay as a major shareholder, be supportive of the business, share some of my experience, but allowing other people to run it in their way?

TLR: Who is going to step into your role?

MT: I’m going through a process at the moment internally. We’ve had six applicants, which was good. That role will be CEO because they probably won’t be a director (Matt’s role has been Managing Director), but they’ll be the head of the company.

TLR: When will you begin transitioning out?

MT: I’ve set the date 1st February 2022.

TLR: You’re not going to hang around? You’re going to give him some clear air?

MT: I’m also happy to hang around for the next calendar year as well. We’ll transition the roles, but for the next year, I think that’s a reasonable transition, depending on what the new CEO would prefer. Then it’ll be from 2023, I’ll be actively making sure I’m not stepping on any toes.

TLR: With the Flight Centre being a publicly listed company, your Pedal Group activities have always been open to the scrutiny of the media and financial analysts. I remember that in the earlier years of the Pedal Group in particular, certain analysts and financial media were having a few digs at you. Maybe not so much you personally, but more along the lines of, ‘What are these guys doing, having this tinpot bicycle company tacked on to this serious business called Flight Centre?’

Do you think those guys might have had to eat a bit of humble pie since covid and the relative changed fortunes of the bike vs travel industry?

MT: I don’t blame them. I think it was a pretty fair question, a good one for them to ask.

The tough thing about it from my perspective, I think, is if things go well, like they have… there’s a bit of luck involved and business is about taking risk. So we’ve taken some risks and they’ve come off. The naysayers, nothing against them, they can just say nothing now. That’s fine.

But if things went bad, it would have looked very bad.

If things go well, they’re sort of, ‘Nothing to see here!’

It was in the back of my mind. It was always a little bit uncomfortable. Maybe you can say a slight burden. There was that pressure where I knew if things went bad, it’s not going to look good. Luckily for everyone, it didn’t go that way.

TLR: What do you think the future holds for the Pedal Group?

MT: Becoming a global retail brand would be high on the list. I think we can be a global retail brand. In a slow and steady way, I think we can grow the retail brand (99 Bikes) into other countries, then we should be able to grow the wholesale behind that.

We have a 2027 goal of having a turnover of $1 billion.

Property is the other. They’re the three arms that we see the business can grow in all three: retail, wholesale, and property. The retail is the centrepiece, because the other two areas do rely on that business operating pretty well.

TLR: Just to clarify regarding property, are you still just referring to securing good leases or are you referring to actually purchasing retail property as that third arm?

MT: Yes, purchasing, is what we’re talking about there. There are two full-time people now purchasing property and looking after that. I certainly believe it’s a good… there’s difference of opinion if you’re looking at having businesses that are very focused, but looking at it all together, I believe that the property is very symbiotic in a few ways. In a financial sense, in an operational sense, I think property ownership works in well. On a simple basis, owning property is lower risk than a business and lower return than a business.

Some people look at that as a negative, but I just like the combination of the high-risk, high-return areas, especially retail and then property as a lower risk, lower return.

It becomes somewhere to invest our money and keeping it in the company, in a way.

I really like that model myself. I see all three arms as important for each other, led by the retail arm.

TLR: If you were at that billion dollar mark, what would be the relative split of the wholesale and retail?

MT: The retail would be the majority of the turnover because that’s where the high turnover does tend to come. Off the top of my head, that retail would be $700 million or so, maybe $750 million of that $1 billion.

Because we have the two businesses separate, but then when we put the accounts together, the internal wholesale sales (those from Advance Traders to 99 Bikes as distinct from those from Advance Traders to independent retailers) get eliminated out. In some areas, wholesale and retail are quite similar in size. As far as how much stock we hold, they’re about similar. Then, when you look at people, obviously retail has a lot more people. When you look at turnover, retail generally has a lot higher turnover.

TLR: What number of stores would that require to reach that 2027 goal?

MT: We’ve got it on a poster somewhere. I’d say roughly 120.

TLR: That would require sales of about $5 or $6 million a store. Does that sound about right?

MT: Yes, I think by that stage. I think at the moment, our stores are averaging around about the $4 million mark. We’d hope to grow up to about the $5 million mark. That sounds about right.

Highlights from Dealer Presentation

On Thursday 25th November the Pedal Group gave a presentation to their dealers across Australia.

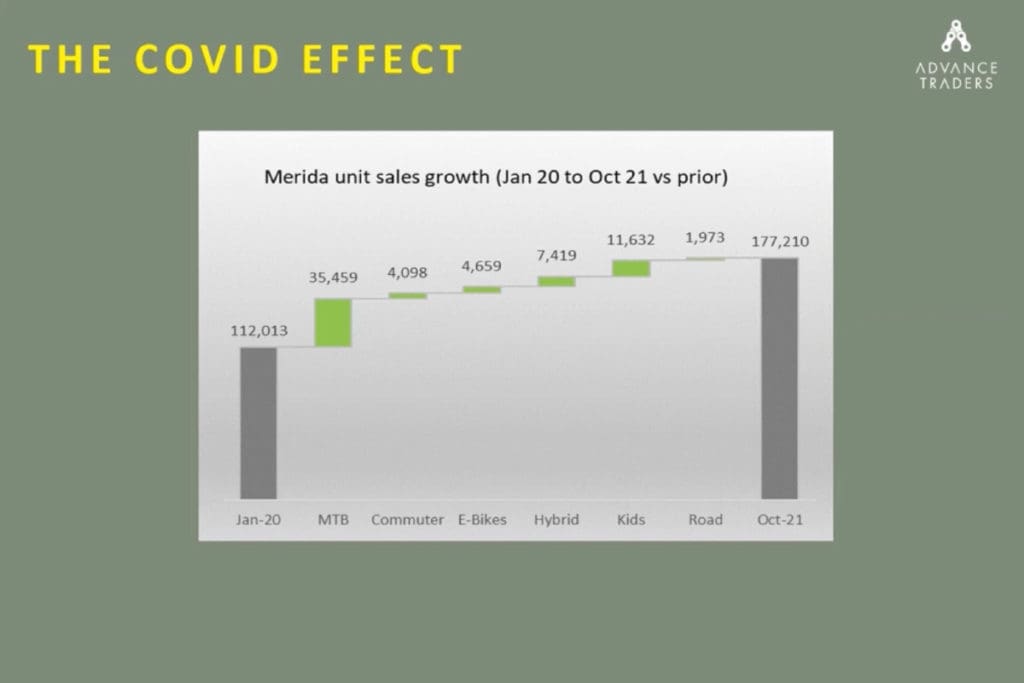

Every bike industry member knows from personal experience the challenges faced since April 2020 when covid induced demand started massively outstripping supply.

The Pedal Group told dealers they had responded by increasing their ordering and stock holdings where possible, increasing staff, increasing their forward orders and looking to diversify supply.

In relation to 99 Bikes, they’ve removed bikes that retail for above $3,000 from their Gold Club membership discount program.

They also shared sales data split by bike brand, across the previous, current and next financial years.

Despite stock challenges, they’re predicting strong growth. In total sales for their wholesale division (Advance Traders) last financial year were $135,267,733. They’re predicting sales of $151,235,138 for the current financial year and $183,481,112 for the 2022/23 financial year.

Merida accounts for approximately half of total sales, followed by Norco, P&A, BMC, their BMX division, E-Green, Mondraker, Velectrix and Moov8.

So interesting to read what motivated Matt to begin 99Bikes. Sounds very similar to the experience I just had at their Modbury SA store.

Great read. The leasing costs are amazing. They really got that right.

Now if you are given $500K to start a bike shop, contact me. Mine is ready to roll.

It’s refreshing to read such detailed answers in an interview rather than the interviewee giving vague answers when asked about financial specifics.

I wonder if they’ll open a store in Cairns any time soon?

That was a great read Phil. Good work!

Thanks very much for your feedback Gary.