Record Low Bicycle Imports for 2023

Canberra, ACT

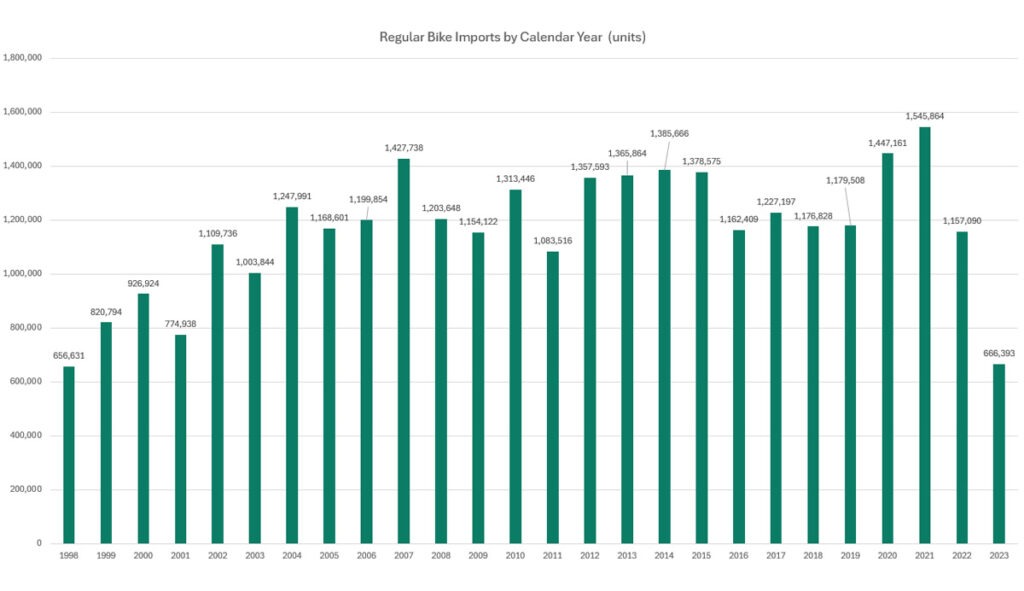

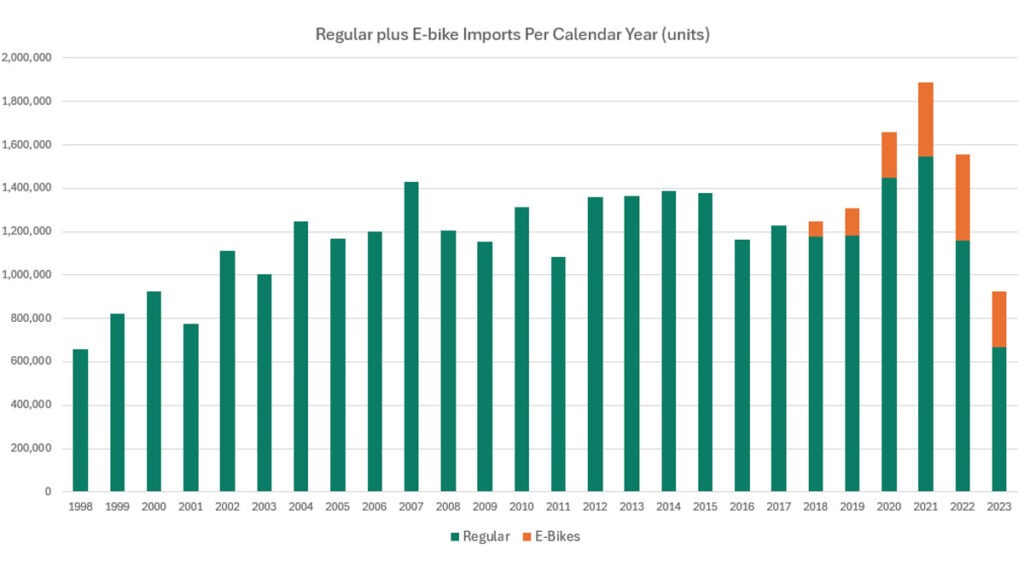

Bicycle import data for December 2023 has now been made available so we can compare the total imports for calendar year 2023 with previous years. The decline has been dramatic.

In total 666,393 conventional (‘analogue’) bicycles were imported in 2023. That’s a drop of almost half a million units, 490,697 to be exact, since 2022’s total of 1,157,090.

2023 was also well under half of the two covid years of 2020 and 2021 which were just under and just over 1.5 million units respectively.

Until 2023, total imports have been more than one million units per year for every year since 2001 – a 22 year run. And you have to go back to 1998 to find a year that was lower, when the total was just over 1% lower at 656,631.

Back in 1998 Australia’s population was 18,706,000 people compared to 26,638,544 in 2023. So on a per capita basis, 2023 bicycle imports were about 42% lower than even the 1998 record low.

The December 2023 monthly import figures themselves that capped off this record low year were 13,658 kids’ bikes and 25,535 adult bikes imported for a monthly total of just 39,193 bicycles. That’s down by 87% compared to the December record of 218,248 bicycles, when covid demand was at a peak and everyone was scrambling for more stock. The typical December figure in the decade pre covid was about 100,000 units.

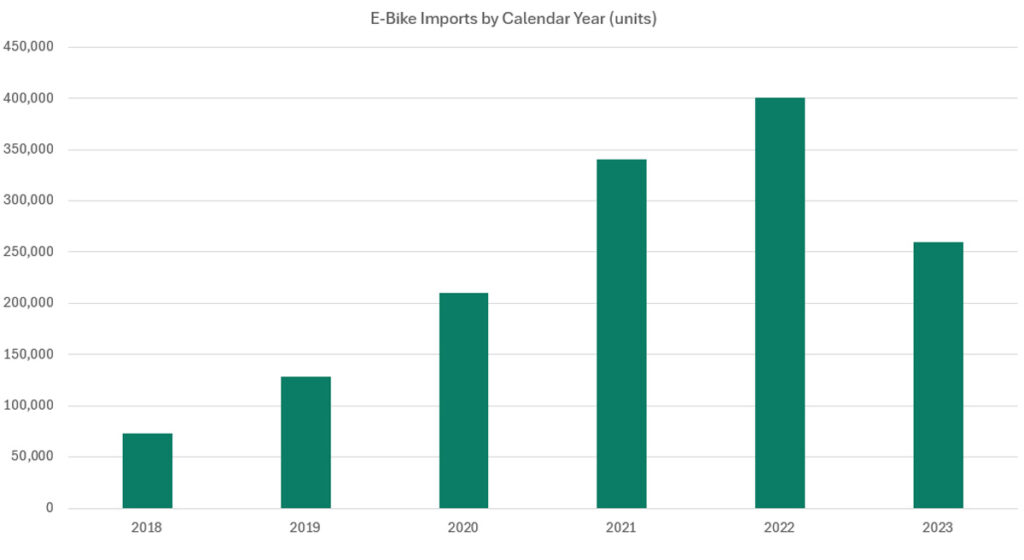

By contrast, e-bike imports for December 2023 were 28,491 units, which was slightly higher than the total of 25,333 e-bikes for December 2020, when the conventional bike import record was set. Per our explanation in previous articles, because the relevant customs code includes e-motorbikes of various styles, the projected e-bike figures above are taking 90% of the total figure to represent e-bicycles.

Although there were still 37% more conventional bikes imported by volume in December 2023, when you multiply the two figures by their respective average unit value (at FOB pricing ie the price that the importer pays the factory before any freight or other charges or mark-ups are added), then the tables are turned.

The unit value of conventional bikes imported was $432.44 compared to $735.40 for the e-bikes.

This means the total value of conventional bikes imported in December 2023 was $16,948,118 compared to $20,952,281 for e-bikes. I looked back through the monthly records and this is actually the fifth time that the monthly value of e-bike imports has been higher than conventional bike imports. It first happened in June 2022 and then in July 2022, May 2023 and July 2023.

We now have 16 consecutive months of lower than average conventional bicycle import data since the brakes went on in September 2022. If retailers are selling at anything close to pre-covid levels, then post-covid overstocks must surely be largely cleared out by now.

Now more than ever, it would be useful to have access to sales data, ideally at both retail and wholesale level to get a better understanding of the current situation and therefore be more easily able to predict future trends.

Without that data, we are not quite flying blind, but certainly flying with a foggy windscreen! Based on the import data plus anecdotal evidence from conversations with bicycle retailers and wholesalers, I would predict that the 2023 bicycle import nosedive should level out to somewhere around ‘normal’ pre-covid monthly import data by the middle of 2024.